Are you ready to take control of your financial future? This comprehensive guide on wealth management will equip you with the knowledge and strategies to effectively grow and protect your assets. Learn how to navigate investment strategies, mitigate financial risks, and build a secure financial plan for long-term wealth creation. Discover practical tips and expert advice to achieve your financial goals and secure your financial security.

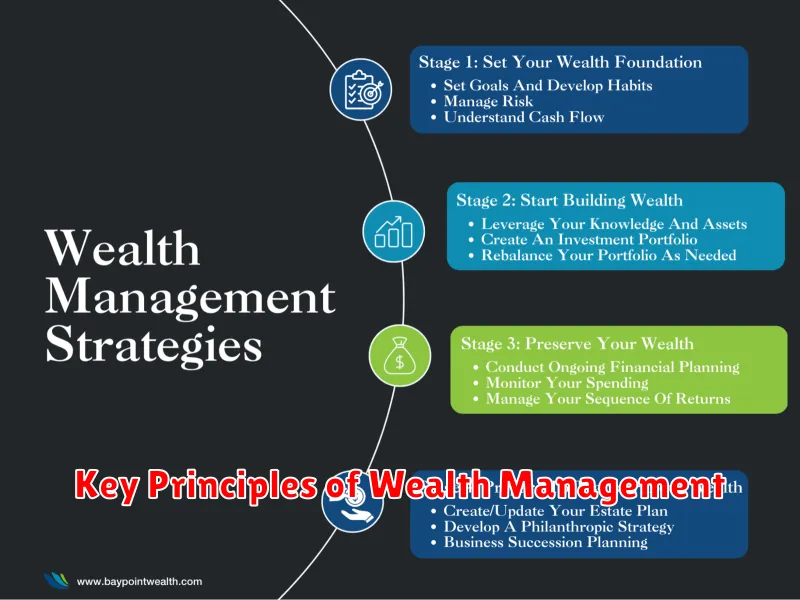

Key Principles of Wealth Management

Effective wealth management rests on several key principles. Financial planning forms the foundation, requiring a clear understanding of your current financial situation, short-term and long-term goals, and risk tolerance. This involves creating a budget, tracking expenses, and setting realistic financial goals.

Diversification is crucial for mitigating risk. Don’t put all your eggs in one basket; spread your investments across various asset classes (stocks, bonds, real estate, etc.) to minimize losses if one area underperforms. This strategy also allows for growth opportunities across different market sectors.

Investment strategies should align with your risk profile and financial goals. Long-term investing generally provides better returns but requires patience and discipline. Understanding different investment vehicles and their associated risks is essential to making informed decisions.

Regular review and adjustments are vital. Your financial situation and goals will change over time, necessitating periodic reviews of your wealth management plan. This allows for timely adjustments to your strategy to ensure it remains aligned with your evolving needs and market conditions. Consider seeking professional advice from a financial advisor for personalized guidance.

Finally, tax optimization is crucial. Understanding tax laws and employing strategies to minimize your tax liability can significantly enhance your long-term wealth accumulation. This often involves working with a tax professional.

How to Create a Sustainable Investment Portfolio

Creating a sustainable investment portfolio involves balancing financial growth with environmental and social responsibility. It requires a long-term perspective and a commitment to aligning your investments with your values.

Diversification is key. Spread your investments across various asset classes, including stocks, bonds, and real estate, to mitigate risk. Consider incorporating ESG (Environmental, Social, and Governance) factors into your investment choices. This means selecting companies with strong sustainability profiles and positive social impact.

Sustainable investing encompasses various strategies. You can invest in companies directly involved in renewable energy, sustainable agriculture, or other environmentally friendly sectors. Alternatively, you can utilize impact investing to support businesses with explicit social missions.

Regularly review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance. Market conditions change, and your investment strategy should adapt accordingly. Consider consulting with a financial advisor specializing in sustainable investments for personalized guidance.

Remember that long-term growth requires patience. Sustainable investing may not always offer the highest short-term returns, but it can contribute to building a financially secure future while also contributing to a more sustainable world.

The Role of Financial Advisors

Financial advisors play a crucial role in wealth management, offering expertise and guidance to help individuals and families grow and protect their assets. Their services extend beyond simple investment advice.

A key function is financial planning. Advisors help clients define their financial goals – retirement, education, or purchasing a home – and create a personalized plan to achieve them. This often involves analyzing current financial situations, assessing risk tolerance, and recommending suitable investment strategies.

Beyond planning, advisors provide ongoing portfolio management. They monitor market trends, rebalance portfolios as needed, and provide regular updates on performance. This proactive approach aims to maximize returns while mitigating risk.

Furthermore, financial advisors offer valuable support in tax planning and estate planning. They help clients structure their finances to minimize tax liabilities and ensure the efficient transfer of assets to heirs. This comprehensive approach ensures the long-term preservation and growth of wealth.

In essence, a financial advisor acts as a trusted partner, providing the knowledge, expertise, and objective perspective needed to navigate the complexities of wealth management effectively.

Tax Optimization Strategies

Effective tax optimization is crucial for wealth management. It involves legally minimizing your tax liability without engaging in tax evasion. Strategies vary based on individual circumstances and should be tailored with the help of a qualified financial advisor.

Diversification of investment assets can help to lower your overall tax burden. Different asset classes are taxed differently, and strategically allocating your investments can reduce your exposure to higher tax rates. For example, holding assets in tax-advantaged accounts like 401(k)s and IRAs can significantly defer or reduce taxes on investment growth.

Tax-loss harvesting is a strategy that involves selling losing investments to offset capital gains taxes. This can reduce your overall tax liability, though it requires careful consideration and should be done in consultation with a tax professional.

Charitable giving can also provide significant tax benefits. Donating to qualified charities can result in tax deductions, lowering your taxable income. Understanding the various charitable giving vehicles, such as donor-advised funds, is important for maximizing these benefits.

Estate planning is a vital component of long-term tax optimization. Strategies like establishing trusts and utilizing gifting strategies can help to minimize estate taxes and transfer wealth efficiently to heirs. Proper planning can significantly reduce the tax burden on your beneficiaries.

It is imperative to consult with qualified tax and financial professionals to develop a personalized tax optimization strategy. They can provide expert advice tailored to your unique financial situation and help you navigate the complexities of tax laws.

Estate Planning for Long-Term Wealth

Estate planning is crucial for securing your long-term financial well-being and ensuring your assets are distributed according to your wishes. It involves proactively managing and protecting your wealth across generations.

A comprehensive estate plan typically includes a will, which dictates how your assets will be divided after your death. This prevents potential family disputes and ensures your assets are handled according to your desires. Trusts can offer further asset protection and tax advantages, particularly for significant estates.

Power of Attorney documents allow you to designate someone to manage your financial affairs if you become incapacitated. A healthcare directive outlines your wishes regarding medical treatment in such circumstances. These proactive measures provide peace of mind and protect your interests.

Regular review and updates to your estate plan are essential, especially after major life events such as marriage, divorce, birth of a child, or significant asset changes. Consulting with an estate planning attorney is highly recommended to ensure your plan aligns with your goals and complies with all legal requirements.

Effective estate planning not only protects your wealth but also provides peace of mind, knowing your family’s future is secure. It’s a vital component of long-term wealth management.

Insurance as a Wealth Protection Tool

Insurance plays a crucial role in comprehensive wealth management, acting as a vital protection mechanism against unforeseen events that could significantly impact your assets.

Various insurance policies address different risks. Life insurance protects your family’s financial well-being in the event of your death, ensuring continued financial support and covering outstanding debts. Disability insurance provides income replacement if you become unable to work due to illness or injury, preventing a loss of earnings and maintaining your lifestyle.

Property insurance safeguards your real estate and personal belongings from damage or loss caused by fire, theft, or natural disasters. Liability insurance protects your assets from legal claims resulting from accidents or negligence, preventing potentially devastating financial consequences.

By strategically utilizing different insurance products, you create a robust safety net to mitigate potential financial setbacks. This proactive approach allows you to focus on growing your wealth, knowing your assets are shielded from unexpected calamities.

Selecting the appropriate coverage requires careful consideration of your individual circumstances, risk tolerance, and financial goals. Consulting with a qualified financial advisor can help you determine the optimal insurance strategy for your unique needs, ensuring your wealth remains protected and secure.

How to Leverage Passive Income

Passive income is crucial for wealth growth and asset protection. It provides a consistent income stream independent of active work, bolstering financial security and accelerating wealth accumulation.

Diversification is key. Explore various passive income streams, minimizing risk and maximizing potential returns. Options include rental properties, dividends from stocks, royalties from intellectual property, and online businesses (e.g., affiliate marketing, e-commerce).

Strategic investment is paramount. Thoroughly research each opportunity, understanding potential risks and rewards. Professional advice from a financial advisor can be invaluable in navigating complex investment strategies.

Careful planning and consistent effort are needed. Building passive income streams often requires upfront investment of time and capital. Maintaining and optimizing these streams requires ongoing management and adaptation.

By strategically leveraging passive income streams, you can achieve long-term financial stability, protect your assets, and accelerate your wealth-building journey.

Common Wealth Management Mistakes to Avoid

One common mistake is underestimating fees. High management fees can significantly erode returns over time. Carefully compare fees across different investment options.

Another frequent error is lack of diversification. Putting all your eggs in one basket increases risk. A well-diversified portfolio across various asset classes mitigates potential losses.

Ignoring inflation is a critical oversight. Inflation diminishes the purchasing power of your assets. A robust wealth management strategy accounts for inflation and aims for returns exceeding inflation.

Failing to plan for taxes can result in significant financial losses. Tax-efficient investment strategies can help minimize your tax burden and maximize your returns. Consult a tax advisor for personalized advice.

Emotional decision-making is detrimental to long-term wealth building. Market fluctuations are inevitable. Sticking to a well-defined investment plan, rather than reacting to short-term market volatility, is crucial.

Finally, neglecting estate planning can lead to complications and unnecessary costs for your heirs. Proper estate planning ensures your assets are distributed according to your wishes and minimizes potential legal battles.