Are you looking for effective tax planning strategies to save more money? This article explores proven methods to reduce your tax liability and maximize your after-tax income. We’ll delve into various tax deductions, credits, and investment strategies designed to help you keep more of your hard-earned money. Discover how smart tax planning can significantly improve your financial well-being. Learn about strategies tailored for different income levels and financial situations, empowering you to make informed decisions and achieve your financial goals.

Understanding the Basics of Tax Planning

Tax planning involves strategically managing your financial affairs to minimize your tax liability within the framework of the law. It’s not about avoiding taxes entirely, but rather about legally reducing your tax burden.

Effective tax planning starts with understanding your taxable income. This includes wages, salaries, investments, and other sources of income. You then identify deductions and credits that can lower your taxable income and, consequently, your tax bill.

Common tax planning strategies include maximizing retirement contributions (401(k)s, IRAs), claiming eligible deductions (mortgage interest, charitable donations), and taking advantage of tax-advantaged investments. The specific strategies will depend on your individual circumstances and financial goals.

Professional advice is often beneficial, especially for complex financial situations. A tax advisor or financial planner can provide personalized guidance and help you develop a comprehensive tax plan tailored to your needs.

Proactive tax planning is key. Don’t wait until tax season to start thinking about your taxes. Implement strategies throughout the year to ensure you’re maximizing your tax savings potential.

Common Tax Deductions and Credits

Effective tax planning involves understanding and utilizing available deductions and credits. Deductions reduce your taxable income, while credits directly reduce your tax liability. Both can significantly lower your overall tax burden.

Common deductions include those for mortgage interest (on your primary residence), state and local taxes (subject to limitations), charitable contributions, and health savings account (HSA) contributions. The specific amounts you can deduct will depend on your individual circumstances and applicable laws.

Popular tax credits often include the earned income tax credit (EITC) for low-to-moderate-income working individuals and families, the child tax credit (CTC) for qualifying children, and the American opportunity tax credit (AOTC) for qualified education expenses. Eligibility requirements vary for each credit.

It’s crucial to maintain accurate records of all expenses that qualify for deductions or credits. Consult a tax professional to ensure you’re taking advantage of all applicable deductions and credits to maximize your tax savings.

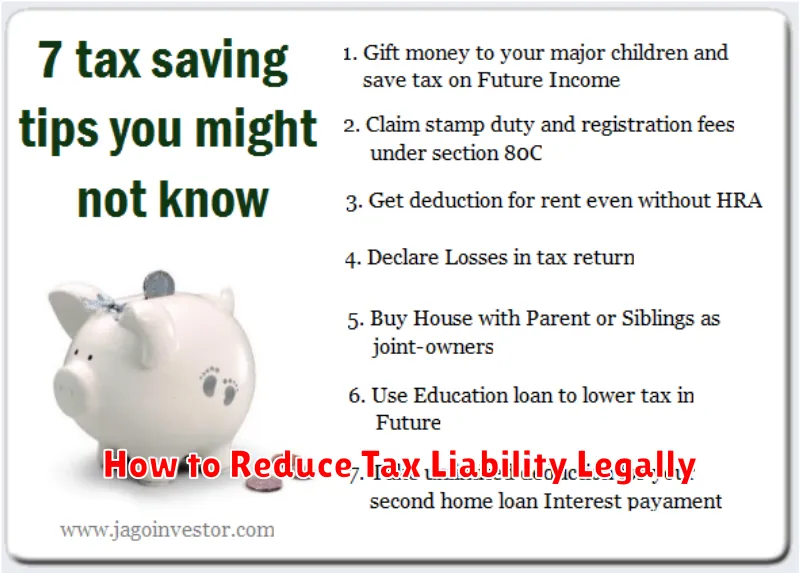

How to Reduce Tax Liability Legally

Reducing your tax liability legally involves proactive tax planning. This isn’t about avoiding taxes, but rather utilizing legal strategies to minimize your tax burden.

One key strategy is maximizing deductions. These can include contributions to retirement accounts (401(k)s, IRAs), charitable donations, and business expenses (if self-employed). Properly documenting and categorizing these deductions is crucial.

Tax credits offer even greater savings than deductions, directly reducing your tax owed. Research available credits based on your circumstances, such as those for childcare, education, or energy efficiency improvements.

Investing in tax-advantaged accounts like Roth IRAs or 529 plans can provide long-term tax benefits. The specifics depend on your financial situation and future goals. Careful asset allocation can further minimize capital gains taxes.

Regular tax planning with a qualified professional is highly recommended. A tax advisor can help you navigate complex regulations, identify applicable deductions and credits, and strategize for long-term tax efficiency. They can also help you stay compliant with all relevant tax laws.

Retirement Accounts and Tax Benefits

Retirement accounts offer significant tax advantages that can substantially boost your savings. Tax-deferred accounts, such as traditional 401(k)s and IRAs, allow you to contribute pre-tax dollars, reducing your current taxable income. This lowers your immediate tax liability, allowing you to save more now.

Tax-advantaged accounts, such as Roth 401(k)s and Roth IRAs, offer a different benefit. Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. This means you pay taxes now but avoid them later, potentially resulting in a larger nest egg.

The choice between tax-deferred and tax-advantaged accounts depends on your individual circumstances, including your current and projected tax bracket. Careful planning is crucial to maximizing the tax benefits and selecting the most suitable account for your needs. Consulting a financial advisor can provide personalized guidance.

Beyond specific account types, understanding contribution limits and withdrawal rules is essential to avoiding penalties and optimizing your tax savings. Staying informed about tax laws and regulations ensures you make the most of these valuable retirement planning tools.

Capital Gains Tax Strategies

Capital gains taxes can significantly impact your investment returns. Effective planning is crucial to minimizing your tax liability. Several strategies can help.

Tax-loss harvesting involves selling losing investments to offset capital gains. This reduces your overall taxable income. Careful timing of sales can also be beneficial. For example, deferring the sale of appreciated assets until a lower tax bracket is reached can save money.

Diversification across different asset classes can help manage risk and potentially lower your tax burden. Consider utilizing tax-advantaged accounts such as Roth IRAs or 401(k)s to shelter long-term growth from taxation.

Gifting appreciated assets to lower-income individuals can shift the tax burden. This strategy can be particularly advantageous for assets held for a long period, allowing the recipient to benefit from a stepped-up basis upon the original owner’s death.

Consult a qualified tax professional for personalized advice tailored to your specific financial situation and investment portfolio. Tax laws are complex, and professional guidance can ensure you are employing the most effective strategies to minimize your capital gains tax.

How to Maximize Tax Refunds

Maximizing your tax refund involves strategic planning throughout the year, not just during tax season. Careful record-keeping is crucial. Maintain detailed records of all income and expenses, especially those eligible for deductions or credits.

Contribute to tax-advantaged accounts like 401(k)s and IRAs. These contributions reduce your taxable income, leading to a larger refund or lower tax liability. Consider Health Savings Accounts (HSAs) if eligible, as contributions are tax-deductible and grow tax-free.

Claim all eligible deductions and credits. Review the IRS publications and utilize tax software or consult a tax professional to ensure you’re not missing any opportunities. Common deductions include those for charitable contributions, mortgage interest, and state and local taxes (SALT).

Understand your filing status. Choosing the correct filing status (single, married filing jointly, etc.) can significantly impact your tax refund. Review your withholding to ensure your employer is withholding the correct amount of taxes. Adjusting your W-4 can help prevent either overpaying or underpaying throughout the year.

Plan for large purchases or significant life events. Timing large purchases or investments strategically can impact your tax liability. Consulting a tax professional can provide personalized advice for your specific financial situation and maximize your tax benefits.

Tax Planning for Freelancers and Business Owners

Effective tax planning is crucial for freelancers and business owners to minimize their tax liability and maximize their profits. Unlike traditional employees with automatic payroll deductions, self-employed individuals have greater responsibility for managing their taxes.

Key strategies include accurately tracking all income and expenses, utilizing eligible deductions such as home office expenses, business-related travel, and professional development costs. Understanding the difference between above-the-line and below-the-line deductions is also vital for optimizing tax savings.

Choosing the right business structure (sole proprietorship, LLC, S-corp, etc.) significantly impacts tax obligations. Consulting with a tax professional is highly recommended to determine the most advantageous structure based on individual circumstances and projected income.

Regular contributions to retirement accounts like SEP IRAs or solo 401(k)s offer tax advantages, reducing taxable income and building retirement savings simultaneously. Planning for estimated quarterly tax payments is essential to avoid penalties and ensure consistent tax management throughout the year.

Proactive tax planning, coupled with sound financial management, empowers freelancers and business owners to retain a greater share of their hard-earned income.

Long-Term Tax Strategies for Wealth Growth

Long-term tax planning is crucial for maximizing wealth accumulation. A key strategy is leveraging tax-advantaged accounts like 401(k)s and IRAs to reduce your current tax burden while building retirement savings. These accounts offer various tax benefits, such as tax-deferred growth or tax-free withdrawals, depending on the specific plan.

Diversification of your investment portfolio across different asset classes can help mitigate risk and potentially optimize tax efficiency. For instance, holding a mix of taxable and tax-advantaged investments allows for strategic harvesting of capital gains and losses to minimize your tax liability.

Estate planning is another vital component of long-term tax strategies. Properly structuring your assets through trusts and other legal vehicles can significantly reduce estate taxes and ensure a smoother transfer of wealth to your heirs. This involves understanding gift tax and estate tax implications and utilizing strategies like gifting to minimize future tax burdens.

Regular tax review with a qualified financial advisor is essential. Tax laws are complex and change frequently; therefore, staying informed and adapting your strategies accordingly is paramount for long-term success. Professional advice can help you navigate the complexities and identify opportunities to optimize your tax situation and achieve your financial goals.