Navigating the turbulent waters of an economic crisis requires a proactive and strategic approach to personal finance management. This article provides essential guidance on how to protect your financial well-being during times of economic uncertainty, covering crucial aspects like budgeting, debt management, emergency fund creation, and investment strategies to help you weather the storm and emerge financially secure. Learn how to safeguard your assets and make informed decisions to mitigate risk and maximize your financial resilience during an economic downturn.

Understanding Economic Downturns

Economic downturns, also known as recessions, are periods of significant decline in economic activity. These periods are characterized by decreases in real GDP (Gross Domestic Product), rising unemployment, and a general sense of economic uncertainty.

Several factors can trigger a downturn. These include decreased consumer spending, reduced business investment, financial crises, and global economic shocks. The severity and duration of these downturns vary, ranging from mild and short-lived to severe and prolonged.

During a downturn, businesses may reduce production, leading to job losses and decreased income for many individuals. Inflation can also increase, reducing the purchasing power of money. Understanding the nature and potential impact of economic downturns is crucial for effective financial planning and management during such periods.

Recognizing the signs of an impending economic downturn, such as slowing economic growth, rising interest rates, and decreased consumer confidence, can allow individuals to take proactive steps to protect their finances.

How to Reassess Your Financial Goals

An economic crisis necessitates a critical review of your financial goals. Prioritize your objectives based on the current realities. What was achievable before may not be feasible now.

Re-evaluate your spending. Identify areas where you can cut back without significantly impacting your quality of life. Track your expenses meticulously to understand where your money goes.

Adjust your savings goals. While aiming for long-term financial security remains vital, you might need to adjust your timeline or target amounts based on the economic situation. Consider focusing on emergency savings first.

Review your investment strategy. A downturn may require a shift in your investment approach. Consult with a financial advisor to adjust your portfolio accordingly, potentially reducing risk.

Consider alternative income streams. Explore part-time work or freelance opportunities to supplement your income and improve your financial resilience.

Communicate with creditors. If you anticipate difficulty meeting financial obligations, proactively contact lenders to explore options like payment plans or loan modifications to avoid defaults.

Regularly reassessing and adapting your financial goals is crucial during an economic crisis. Flexibility and proactive planning are key to navigating challenging times and ensuring long-term financial well-being.

Smart Budgeting in Tough Times

Economic crises necessitate a shift in financial priorities. Smart budgeting becomes crucial for navigating uncertainty. This involves a meticulous review of your spending habits.

Prioritize essential expenses such as housing, food, and transportation. Identify areas where you can cut back on non-essential spending, such as entertainment or dining out. Consider cheaper alternatives or temporarily forgoing these expenses altogether.

Creating a detailed budget is paramount. Track your income and expenses diligently to understand where your money is going. Many budgeting apps and spreadsheets can help automate this process and provide valuable insights.

Explore opportunities to increase your income. This could involve seeking a second job, freelancing, or selling unused possessions. Every additional stream of income can provide a significant buffer during tough times.

Building an emergency fund is essential. Aim to save at least 3-6 months’ worth of living expenses. This fund provides a crucial safety net to cover unexpected costs and prevent debt accumulation during economic downturns.

Negotiating with creditors for lower payments or extended deadlines can alleviate financial stress. Open communication is key to finding mutually beneficial solutions. Consider consolidating high-interest debts to simplify payments and potentially lower your interest rate.

Finally, seek professional financial advice if needed. A financial advisor can provide personalized guidance and strategies to help you navigate your financial situation effectively during an economic crisis.

Emergency Funds: How Much is Enough?

Building a robust emergency fund is crucial during economic crises. While there’s no one-size-fits-all answer, a general guideline is to aim for 3-6 months’ worth of living expenses.

This amount should cover your essential costs like rent/mortgage, utilities, groceries, transportation, and debt payments. The higher end of this range (6 months) provides a greater safety net for prolonged periods of unemployment or unexpected major expenses.

Factors influencing the ideal amount include your job security, personal debt levels, and family responsibilities. Individuals in less stable employment situations or with higher debt may benefit from having a larger emergency fund.

Consider regularly contributing to your emergency fund, even small amounts, to build it gradually. This proactive approach will help you weather financial storms more effectively and reduce stress during challenging economic times.

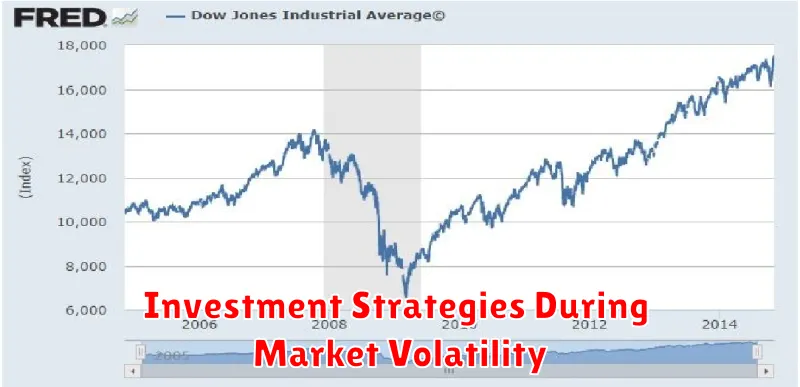

Investment Strategies During Market Volatility

Market volatility during an economic crisis presents both challenges and opportunities for investors. A key strategy is to maintain a diversified portfolio. This reduces the impact of any single investment’s downturn. Consider diversifying across different asset classes, such as stocks, bonds, and real estate, as well as across different sectors and geographies.

Dollar-cost averaging is another effective technique. This involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

Rebalancing your portfolio is crucial. During periods of volatility, some assets may outperform others, leading to an imbalance. Rebalancing involves selling some overperforming assets and buying underperforming ones to restore your target asset allocation. This helps to capitalize on market opportunities and mitigate risk.

It’s vital to have a long-term perspective. Short-term market fluctuations are normal, and panicking and making rash decisions based on fear can be detrimental to long-term investment goals. Sticking to your investment plan and remaining disciplined is crucial during times of uncertainty.

Finally, consider consulting with a qualified financial advisor. They can provide personalized guidance based on your individual risk tolerance, financial goals, and investment timeline.

Debt Management in Uncertain Times

Economic crises often exacerbate existing financial burdens. Effective debt management becomes crucial during such periods. Prioritize debts based on interest rates; high-interest debts should be addressed first.

Consider negotiating with creditors. Many lenders are willing to work with borrowers facing hardship, offering options like reduced payments or temporary forbearance. Document all agreements in writing.

Budgeting rigorously is paramount. Track all income and expenses meticulously to identify areas for potential savings. Explore opportunities to reduce non-essential spending.

Emergency funds provide a crucial buffer against unexpected expenses. Aim to build at least three to six months’ worth of living expenses. This can prevent resorting to high-interest debt during difficult times.

If necessary, seek professional financial advice. A certified financial planner can help create a personalized debt management strategy and provide guidance navigating complex financial situations.

Government Assistance and Support Programs

Economic crises often necessitate seeking government assistance. Numerous programs exist to help individuals and families manage financial hardship. Eligibility criteria vary significantly depending on the specific program and your circumstances.

Unemployment benefits provide temporary financial support to those who have lost their jobs through no fault of their own. Food assistance programs, such as SNAP (Supplemental Nutrition Assistance Program), offer crucial help with grocery expenses. Housing assistance programs can help prevent homelessness through rent subsidies or direct financial aid.

Healthcare programs, like Medicaid, expand access to affordable healthcare during times of economic strain. Energy assistance programs help low-income households pay their energy bills, especially vital during colder months. Small business loans and grants might be available to help businesses survive economic downturns.

It’s crucial to research available programs in your area. Contact your state or local government agencies, or utilize online resources to find comprehensive information on eligibility requirements and application processes. Taking advantage of these resources can provide crucial support during a financial crisis.

Steps to Rebuild Your Finances After a Crisis

Rebuilding your finances after an economic crisis requires a structured approach. Begin by creating a realistic budget, meticulously tracking all income and expenses. Identify areas where you can reduce spending and prioritize essential expenses like housing and food.

Next, assess your debt. Prioritize paying down high-interest debt, such as credit cards, to minimize interest charges. Consider debt consolidation or negotiating with creditors for lower interest rates or payment plans. This will help you manage your debt more effectively.

Simultaneously, focus on building an emergency fund. Aim for at least three to six months’ worth of living expenses. This fund serves as a crucial safety net to protect you against future unforeseen circumstances.

Explore opportunities to increase your income. This might involve seeking a higher-paying job, taking on a part-time job, or monetizing skills through freelancing or a side hustle. Even small increases in income can significantly impact your progress.

Finally, be patient and persistent. Rebuilding finances takes time and discipline. Regularly review your budget, track your progress, and celebrate your achievements along the way. Seeking guidance from a financial advisor can also prove beneficial.