Are you looking to maximize your wealth and achieve your financial goals? This article unveils top investment strategies designed to help you build a strong financial future. We will explore proven methods for growing your investments, including diversifying your portfolio, understanding risk tolerance, and leveraging various asset classes for optimal returns. Learn how to navigate the complexities of the investment world and make informed decisions to secure your financial prosperity. Discover the best investment strategies tailored to various risk profiles and financial objectives, empowering you to take control of your financial destiny and achieve lasting wealth creation.

Understanding Risk and Return

Investing involves a fundamental trade-off between risk and return. Higher potential returns typically come with higher risk, meaning a greater chance of losing some or all of your investment.

Risk refers to the possibility of losing money. This can stem from various sources, including market volatility, company-specific issues, or macroeconomic factors. Different investment vehicles carry different levels of risk; for example, stocks are generally considered riskier than bonds.

Return represents the profit or income generated from an investment. This can be in the form of capital appreciation (increase in the value of the asset) and/or income (dividends, interest). The return you achieve will depend on both the investment’s performance and the time horizon.

Understanding your own risk tolerance is crucial. This is your capacity to withstand potential losses without altering your investment strategy. It’s essential to align your investment choices with your risk tolerance and financial goals. A younger investor with a longer time horizon might be comfortable with higher-risk investments, while an older investor nearing retirement might prioritize preserving capital over chasing high returns.

Diversification is a key strategy to manage risk. By spreading your investments across different asset classes, you reduce the impact of any single investment performing poorly. This doesn’t eliminate risk, but it helps to mitigate it.

Diversification Techniques

Diversification is a fundamental investment strategy aimed at reducing risk by spreading investments across various asset classes. This minimizes the impact of poor performance in one area on your overall portfolio.

Asset class diversification involves investing in stocks, bonds, real estate, commodities, and alternative investments. Each asset class reacts differently to market conditions, offering a buffer against losses.

Geographic diversification reduces reliance on a single country’s economy. Investing globally spreads risk across various economic regions and reduces exposure to country-specific risks.

Sector diversification focuses on spreading investments across different industries. This protects against sector-specific downturns. For example, investing in both technology and healthcare reduces risk if one sector underperforms.

Style diversification involves investing in different investment styles, such as growth stocks, value stocks, or large-cap, mid-cap, and small-cap companies. Each style has different risk and return profiles, offering a balanced approach.

Effective diversification requires careful consideration of your risk tolerance and investment goals. It’s crucial to regularly rebalance your portfolio to maintain your desired asset allocation and manage risk effectively.

Long-term vs Short-term Investing

Long-term investing focuses on holding assets, such as stocks or real estate, for an extended period, typically several years or even decades. This strategy aims to benefit from long-term growth and compound returns, mitigating the impact of short-term market fluctuations. It generally involves lower risk and potentially higher rewards over time.

Short-term investing, conversely, involves holding assets for a shorter duration, often less than a year. This approach prioritizes quick profits and capitalizes on short-term market trends. It is typically considered more volatile and carries a higher degree of risk, with potentially higher returns but also significant losses if market conditions turn unfavorable.

The optimal strategy depends on individual risk tolerance, financial goals, and time horizon. Long-term investing is generally favored for retirement planning or other long-term financial objectives, while short-term investing might suit individuals with shorter-term goals or higher risk tolerance seeking faster returns. Diversification across both long-term and short-term investments can be a prudent approach for a balanced portfolio.

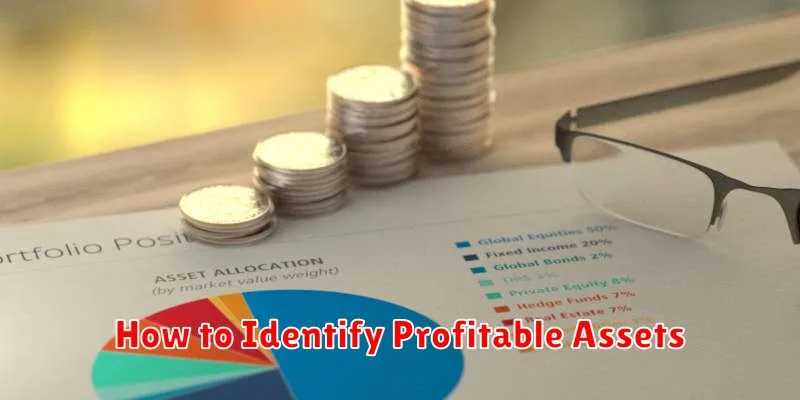

How to Identify Profitable Assets

Identifying profitable assets requires a multifaceted approach. Begin by analyzing the asset’s potential for appreciation. This involves researching market trends, considering factors like inflation and economic growth, and evaluating the asset’s historical performance. Due diligence is crucial; thoroughly investigate the asset’s characteristics, risks, and potential downsides.

Next, consider the asset’s cash flow potential. Will it generate income through dividends, rent, or other means? A consistent stream of passive income significantly increases profitability. Analyze the liquidity of the asset; how easily can it be converted into cash if needed? High liquidity reduces risk and allows for greater flexibility.

Finally, assess the overall risk profile. Higher potential returns usually come with higher risk. Diversifying your portfolio across different asset classes helps mitigate risk. Comparing potential returns against the level of risk is essential for making informed decisions. Remember, a truly profitable asset offers a balance between risk and reward that aligns with your personal financial goals and risk tolerance.

Market Trends and Analysis

Analyzing current market trends is crucial for maximizing investment returns. Macroeconomic indicators such as inflation, interest rates, and GDP growth significantly impact investment performance. Understanding these factors allows investors to anticipate market shifts and adjust their portfolios accordingly.

Geopolitical events also play a substantial role. International conflicts, trade agreements, and political instability can cause significant market volatility. Staying informed about these events enables investors to mitigate potential risks and identify opportunities arising from global uncertainties.

Sector-specific analysis is equally important. Identifying industries poised for growth, based on technological advancements, consumer demand, or regulatory changes, can provide significant returns. This requires careful evaluation of individual company performance within those sectors.

Finally, monitoring market sentiment, including investor confidence and overall market psychology, offers valuable insights. Understanding shifts in sentiment allows for proactive portfolio management, potentially minimizing losses during periods of market downturn.

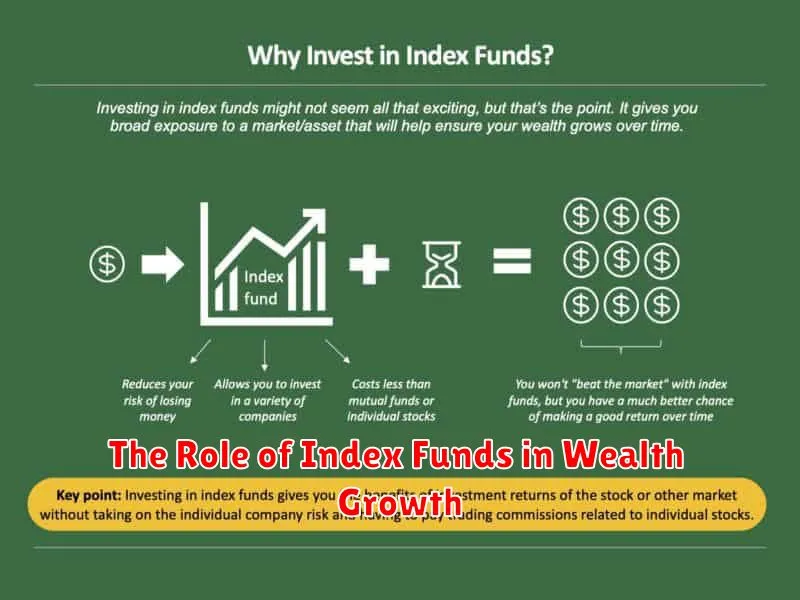

The Role of Index Funds in Wealth Growth

Index funds offer a passive investment strategy designed to mirror a specific market index, like the S&P 500. This approach eliminates the need for active stock picking, reducing costs and potential for underperformance.

Diversification is a key benefit. Index funds instantly provide exposure to a broad range of companies, mitigating risk associated with individual stock volatility.

Lower expense ratios are another significant advantage. Compared to actively managed funds, index funds generally have significantly lower fees, allowing for greater returns over the long term.

Long-term growth is the primary goal. Index funds are best suited for investors with a long-term horizon, as market fluctuations are expected but historically, the market trends upward.

While not guaranteed, the historical performance of broad market index funds supports their role in building wealth through consistent, low-cost participation in market growth.

Alternative Investment Options

Diversifying your portfolio beyond traditional stocks and bonds can significantly enhance your wealth-building strategy. Alternative investments offer unique opportunities for growth and potentially higher returns, but also come with increased risk.

Real estate remains a popular choice, offering potential for rental income and capital appreciation. However, it requires significant capital outlay and involves management responsibilities.

Private equity involves investing in privately held companies, offering high growth potential but with limited liquidity and higher risk. Hedge funds, employing complex trading strategies, also present significant risk alongside the possibility of substantial returns.

Commodities, such as gold and oil, can act as a hedge against inflation and market volatility, but their prices are subject to significant fluctuation.

Collectibles, including art, wine, and rare stamps, can appreciate significantly over time, but require specialized knowledge and a long-term investment horizon. Before investing in any alternative asset, thorough research and professional advice are crucial to assess your risk tolerance and align your investment with your financial goals.

Common Investment Mistakes to Avoid

One of the biggest mistakes is emotional investing. Letting fear or greed drive decisions, rather than a well-defined strategy, often leads to poor outcomes. Avoid impulsive buying or selling based on short-term market fluctuations.

Ignoring diversification is another critical error. Concentrating investments in a single asset class or a few companies exposes you to significant risk. Diversification across different asset classes (stocks, bonds, real estate, etc.) helps mitigate potential losses.

Failing to research thoroughly before investing is a common pitfall. Understanding a company’s financials, management team, and industry outlook is crucial before committing your capital. Relying solely on tips or hearsay can be disastrous.

Neglecting to set financial goals results in aimless investing. Without clear goals (retirement, education, etc.), it’s difficult to create a suitable investment plan and measure progress. Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals.

Finally, avoiding professional advice can be detrimental, especially for complex investment strategies. While not necessary for all investors, seeking guidance from a qualified financial advisor can provide valuable insights and help avoid costly mistakes.