Investing can feel daunting, especially for beginners. However, building a strong financial future requires starting somewhere, and this guide explores the best investment options tailored specifically for those just beginning their investment journey. We’ll demystify various investment strategies, providing a clear understanding of low-risk investments, high-growth potential options, and the crucial factors to consider when selecting the right investment portfolio for your unique circumstances and financial goals. Discover how to navigate the world of investing with confidence and make informed decisions to achieve your long-term financial success.

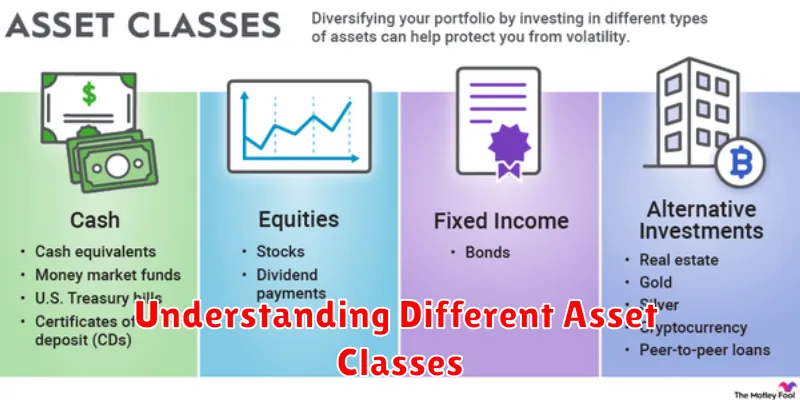

Understanding Different Asset Classes

Understanding different asset classes is crucial for building a diversified investment portfolio. Asset classes represent groups of investments with similar characteristics and risk profiles. Diversification across different asset classes helps to mitigate risk and potentially enhance returns.

Stocks (Equities) represent ownership in a company. They offer the potential for high growth but also carry higher risk compared to other asset classes. Bonds are debt instruments representing a loan to a company or government. They generally offer lower returns than stocks but are considered less risky.

Real Estate involves investing in properties, either directly or through REITs (Real Estate Investment Trusts). It can offer diversification benefits and potential for rental income but is often illiquid and requires significant capital investment. Cash and Cash Equivalents include savings accounts, money market funds, and short-term Treasury bills. They are highly liquid and offer minimal risk but typically provide low returns.

Commodities encompass raw materials like gold, oil, and agricultural products. They can serve as a hedge against inflation but are subject to significant price volatility. Alternative Investments include hedge funds, private equity, and collectibles. These options often have higher barriers to entry and require specialized knowledge.

Choosing the right mix of asset classes depends on your individual risk tolerance, investment goals, and time horizon. It is advisable to consult with a financial advisor to determine an appropriate allocation for your specific circumstances.

Stocks vs Bonds: Which One to Choose?

For beginners, choosing between stocks and bonds often presents a crucial dilemma. Stocks represent ownership in a company and offer the potential for higher returns but also carry higher risk. Their value fluctuates based on company performance and market conditions.

Bonds, on the other hand, are essentially loans you make to a government or corporation. They offer a fixed income through regular interest payments and typically present lower risk than stocks. However, their returns are generally lower.

The best choice depends on your risk tolerance, investment timeline, and financial goals. If you have a longer time horizon and can tolerate higher risk for potentially greater returns, stocks might be a better fit. If you prioritize capital preservation and steady income, bonds could be a more suitable option. Many investors diversify their portfolios by including both stocks and bonds to balance risk and reward.

Consider consulting a financial advisor for personalized guidance before making any investment decisions.

Index Funds and ETFs for Beginners

For beginners, index funds and exchange-traded funds (ETFs) offer a simple, low-cost way to invest in the stock market. They track a specific market index, like the S&P 500, providing diversified exposure to a large number of companies.

Index funds are passively managed mutual funds that aim to mirror the performance of a particular index. They typically have lower expense ratios than actively managed funds.

ETFs, similar to index funds, track an index but trade like stocks on exchanges throughout the day. This allows for intraday trading and potentially greater flexibility.

Both index funds and ETFs are excellent options for beginners seeking long-term growth and diversification with minimal management effort. However, it’s crucial to understand the nuances of each before investing. Consider your investment timeline and risk tolerance when making your choice.

Important Note: Investing involves risk, including the potential loss of principal. It’s recommended to consult with a financial advisor before making any investment decisions.

Real Estate as an Investment

Real estate offers a tangible asset with potential for long-term growth and passive income. Investing in properties, whether residential or commercial, can provide consistent rental returns and appreciate in value over time. However, it requires significant capital for down payments and closing costs.

Risk factors include market fluctuations, property maintenance costs, and vacancy periods. Thorough due diligence, including property inspections and market research, is crucial. Understanding local zoning laws and property taxes is also essential.

Diversification within a real estate portfolio can mitigate risk. This can involve investing in different property types, locations, or through REITs (Real Estate Investment Trusts). Professional advice from real estate agents, financial advisors, and lawyers is highly recommended.

While potentially lucrative, real estate investing demands time, effort, and financial resources. Beginners should carefully weigh the benefits and drawbacks before committing to this investment option.

Cryptocurrency Investment Risks and Rewards

Cryptocurrencies offer the potential for high returns due to their volatility and the possibility of early adoption of groundbreaking technologies. Early investors in Bitcoin, for example, have seen phenomenal gains. However, this potential for reward is coupled with significant risk.

One major risk is the extreme volatility of the cryptocurrency market. Prices can fluctuate dramatically in short periods, leading to substantial losses. Market manipulation and regulatory uncertainty further contribute to this volatility and unpredictability.

Another significant risk is the potential for theft or loss of funds through hacking, scams, or the loss of private keys. The decentralized nature of cryptocurrencies, while offering benefits, also means there is often limited recourse if something goes wrong.

Furthermore, the lack of regulation in many jurisdictions creates a potentially risky environment. This lack of oversight can lead to fraudulent activities and a lack of consumer protection. Tax implications can also be complex and vary widely depending on location.

Before investing in cryptocurrencies, beginners should carefully weigh these risks and rewards. It’s crucial to understand the technology, conduct thorough research, and only invest what you can afford to lose. Diversification across different assets is also a wise strategy to mitigate risk.

Diversification Strategies for New Investors

Diversification is crucial for mitigating risk in investing. It involves spreading investments across various asset classes to reduce the impact of poor performance in any single area. For new investors, a simple approach is key.

Asset Allocation: A foundational strategy is to allocate funds across different asset classes. This typically includes stocks (representing ownership in companies), bonds (representing loans to governments or corporations), and cash (providing liquidity and stability). The specific allocation depends on your risk tolerance and investment timeline, but a common starting point involves a mix of all three.

Stock Diversification: Within stocks, diversification can be achieved through investing in different sectors (e.g., technology, healthcare, consumer goods) and market capitalizations (e.g., large-cap, mid-cap, small-cap). This reduces reliance on any single company or industry’s performance.

Index Funds and ETFs: For beginners, low-cost index funds or exchange-traded funds (ETFs) offer instant diversification across a broad market segment. These funds track a specific market index, providing exposure to numerous companies without the need for individual stock picking.

Geographic Diversification (Optional): For a more advanced approach, consider international diversification, which spreads investments across different countries. This can help reduce the impact of economic downturns in a single region. However, this strategy should generally be pursued after building a foundation of domestic diversification.

Rebalancing: Regularly rebalancing your portfolio is essential. This involves adjusting your asset allocation back to your target percentages to maintain your desired level of risk and return. Rebalancing can involve selling assets that have performed well and buying assets that have underperformed.

Professional Advice (Optional): Consider seeking advice from a qualified financial advisor for personalized guidance tailored to your specific financial situation, goals, and risk tolerance.

How to Start with Small Capital

Starting your investment journey with limited capital requires a strategic approach. Consistency is key. Even small, regular contributions to your investment accounts will compound over time, leading to significant growth. Consider starting with dollar-cost averaging, where you invest a fixed amount at regular intervals, regardless of market fluctuations. This mitigates the risk of investing a lump sum at a market high.

Low-cost index funds or exchange-traded funds (ETFs) are excellent choices for beginners with small capital. They offer broad market diversification at a low expense ratio, minimizing fees that can significantly impact returns, especially on smaller investments. Focus on long-term growth and avoid chasing short-term gains. Your investment timeline should align with your financial goals, allowing your investments to grow steadily over time.

High-yield savings accounts and certificates of deposit (CDs) can provide a safe place for your initial capital while you learn more about investing. They offer relatively low returns but are ideal for building a foundation and ensuring your money is safe and accessible. Prioritize paying off high-interest debt before investing as the interest you save will be greater than any returns on small investments.

Remember to educate yourself before investing. Take advantage of free resources online and at your local library to learn about investing strategies, risk management, and financial planning. Start small, stay consistent, and be patient. Building wealth takes time, but starting with even a small amount is a crucial first step.

Long-Term vs Short-Term Investment Approaches

For beginners, understanding the difference between long-term and short-term investment approaches is crucial. Long-term investing, typically spanning several years or even decades, focuses on building wealth steadily through consistent contributions and market growth. It’s less susceptible to short-term market fluctuations and generally offers higher potential returns.

Short-term investing, on the other hand, aims for quicker returns, often within a year or less. This strategy is more reactive to market changes and carries higher risk. While it can yield profits faster, it also exposes investors to greater volatility and the potential for losses. The choice between these approaches depends heavily on individual risk tolerance, financial goals, and time horizon.

Long-term strategies often involve investments like index funds or exchange-traded funds (ETFs), allowing for diversified exposure to a broad market segment. Short-term strategies might include high-yield savings accounts, short-term bonds, or even day trading (though this is considered highly risky for beginners).

Beginners are generally advised to favor long-term strategies due to their lower risk profile and potential for greater long-term growth. However, a balanced approach, combining elements of both short-term and long-term investment, may be suitable for some, depending on their specific circumstances and goals.