Effective financial planning necessitates a comprehensive strategy, and insurance plays a crucial role in mitigating potential financial risks. Understanding the various types of insurance, from health insurance and life insurance to disability insurance and property insurance, is paramount for securing your financial future. This article explores the vital role of insurance in building a robust financial plan, protecting your assets, and ensuring financial security for yourself and your loved ones.

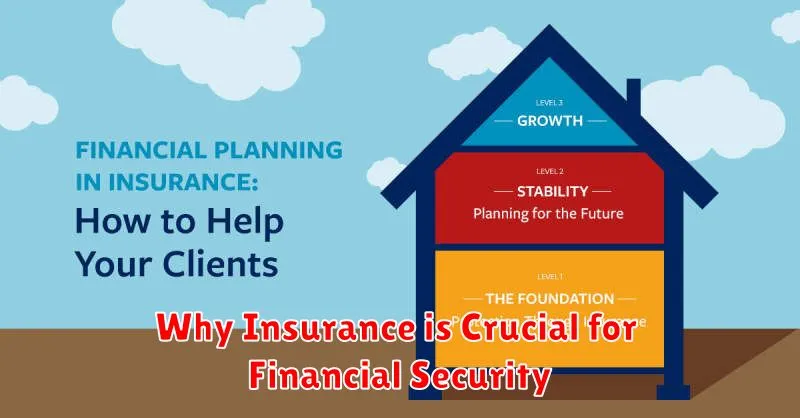

Why Insurance is Crucial for Financial Security

Insurance plays a vital role in securing your financial future by mitigating the risks associated with unforeseen events. Without adequate insurance coverage, a single catastrophic event, such as a serious illness, a major accident, or property damage, could quickly deplete your savings and leave you facing significant financial hardship.

Health insurance protects against the crippling costs of medical treatment and hospitalization. Life insurance provides financial security for your dependents in the event of your death, ensuring their continued well-being. Homeowners or renters insurance safeguards your property against damage from fire, theft, or natural disasters.

Auto insurance is essential to cover liability and damages related to vehicle accidents. These various types of insurance offer a crucial safety net, protecting your assets and providing peace of mind against unpredictable circumstances. By strategically planning your insurance coverage, you can protect your financial well-being and secure a more stable future.

Types of Insurance Everyone Should Have

Health insurance is paramount, providing coverage for medical expenses, preventing crippling debt from illness or injury. Choosing a plan that meets your needs and budget is crucial.

Auto insurance is a legal requirement in most places, protecting you financially in case of accidents. Liability coverage is essential, while collision and comprehensive coverage offer additional protection.

Homeowners or renters insurance safeguards your belongings and provides liability protection. Homeowners insurance covers your home and its contents, while renters insurance protects your personal property.

Life insurance protects your loved ones financially in the event of your death. The type and amount of coverage depend on individual circumstances and financial obligations.

While not universally required, disability insurance offers crucial financial support if you become unable to work due to illness or injury. It ensures continued income during a difficult period.

The specific types and amounts of insurance needed will vary depending on individual circumstances, but these five represent a strong foundation for a comprehensive financial plan.

How Life Insurance Supports Wealth Planning

Life insurance plays a crucial role in comprehensive wealth planning by providing a financial safety net for unexpected events. The death benefit can act as a crucial source of funds to cover outstanding debts like mortgages, loans, and credit card balances, preventing financial hardship for surviving family members.

Beyond debt protection, life insurance can help preserve your estate’s value. The death benefit can replace lost income, ensuring financial stability for dependents, supporting education expenses, or funding retirement goals. This allows the family to maintain their desired lifestyle and avoid forced asset liquidation.

Furthermore, certain types of life insurance policies, such as whole life insurance, offer a cash value component that grows tax-deferred. This can serve as a source of funds for future needs, such as college tuition or healthcare expenses, without impacting the death benefit. This element adds a savings and investment aspect to wealth planning.

Careful consideration of coverage amount and policy type is vital for effective wealth planning. Working with a financial advisor helps determine the appropriate level of coverage to meet individual financial goals and protect the accumulated wealth for future generations. Life insurance is a powerful tool to secure a family’s financial future and maintain long-term wealth.

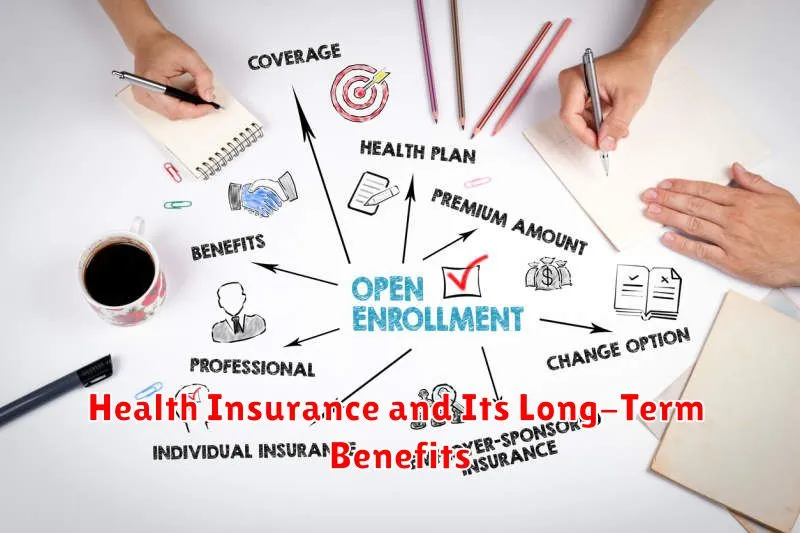

Health Insurance and Its Long-Term Benefits

Health insurance plays a crucial role in long-term financial planning by mitigating the potentially devastating financial impact of unexpected medical expenses. The cost of healthcare, including hospitalization, surgery, and ongoing treatment, can quickly deplete savings and create significant debt.

Long-term benefits include protection against financial ruin from unexpected illness or injury. It provides access to preventive care, potentially reducing the likelihood of serious and costly health issues down the line. Furthermore, maintaining consistent health coverage often translates to better health outcomes and increased longevity.

Choosing the right plan is essential. Factors to consider include coverage levels, premiums, deductibles, and co-pays. Comparing plans and understanding your individual needs ensures you receive adequate protection without unnecessary expense. While premiums represent a recurring cost, the financial security offered by health insurance far outweighs the potential risks of going without it.

In conclusion, investing in comprehensive health insurance is a vital component of a sound financial plan, safeguarding your financial future and promoting your long-term well-being.

How to Choose the Right Insurance Plan

Choosing the right insurance plan requires careful consideration of your individual needs and financial situation. Begin by assessing your risks. What are your biggest financial vulnerabilities? Consider health, life, property, and liability risks.

Next, determine your coverage needs. For health insurance, consider factors like deductibles, co-pays, and network providers. For life insurance, determine the appropriate death benefit amount based on your dependents’ financial needs. Property insurance should cover the full replacement cost of your assets.

Compare different plans and providers. Obtain quotes from multiple insurers and carefully review policy details, including exclusions and limitations. Don’t solely focus on price; consider the overall value and reputation of the insurer.

Read the fine print. Understand the policy’s terms and conditions thoroughly before signing. Pay close attention to exclusions, waiting periods, and any limitations on coverage.

Finally, regularly review and adjust your insurance coverage as your circumstances change. Life events like marriage, having children, or changes in income can significantly impact your insurance needs. Consult with a financial advisor for personalized guidance.

Common Insurance Mistakes to Avoid

Underinsurance is a significant mistake. Failing to adequately cover assets, liabilities, or potential losses leaves you vulnerable to substantial financial hardship in the event of an accident or unforeseen circumstances. Proper coverage should reflect your current needs and future projections.

Ignoring insurance needs altogether is another common error. Many postpone or avoid purchasing insurance, believing it’s unnecessary or too expensive. This can result in catastrophic financial consequences if an unexpected event occurs. A comprehensive financial plan necessitates adequate insurance coverage.

Failing to review policies regularly is a critical oversight. Your needs change over time, meaning your insurance coverage may become inadequate. Regularly reviewing policies ensures your coverage aligns with your current circumstances and that you’re receiving the best possible value for your premiums.

Choosing the cheapest policy without considering coverage is a false economy. While premiums are an important consideration, inadequate coverage can be far more expensive in the long run. Consider the comprehensive coverage offered and ensure it sufficiently protects your assets and future financial stability.

Not understanding your policy can lead to missed claims or inefficient utilization of your benefits. Taking the time to understand the terms, conditions, and exclusions of your insurance policies is crucial for maximizing their benefits and mitigating potential financial risks.

The Role of Disability and Unemployment Insurance

Disability insurance provides crucial financial protection in the event of a debilitating illness or injury preventing work. It replaces a portion of lost income, ensuring continued financial stability during a period of recovery and rehabilitation. This is particularly important as medical bills can be substantial, and the inability to work often leads to significant income loss.

Unemployment insurance serves as a safety net for individuals who have lost their jobs through no fault of their own. It provides temporary income support while they actively search for new employment, preventing immediate financial hardship. While the benefits typically don’t replace the entire salary, they offer a cushion to cover essential expenses such as rent, utilities, and groceries.

Both disability and unemployment insurance play a significant role in comprehensive financial planning. They offer critical protection against unforeseen circumstances that can severely impact an individual’s financial well-being. Their inclusion in a robust financial plan mitigates risk and promotes financial security, providing peace of mind during difficult times.

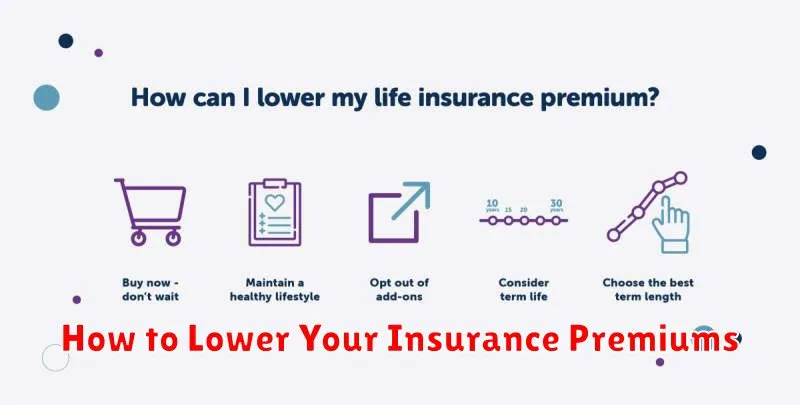

How to Lower Your Insurance Premiums

Reducing your insurance premiums requires a multi-pronged approach. Careful comparison shopping is crucial. Obtain quotes from multiple insurers to find the best rates for your needs. Don’t hesitate to switch providers if you discover a significantly better offer.

Improving your credit score can substantially impact your premiums. Insurers often consider credit history as a factor in risk assessment. A higher score generally translates to lower premiums.

Increasing your deductible is another effective strategy. A higher deductible means you pay more out-of-pocket in case of a claim, but it lowers your monthly premiums. Carefully weigh the risk against the potential savings.

Bundling your insurance policies with the same provider (e.g., home and auto) often results in significant discounts. This is a simple way to save money without sacrificing coverage.

Maintaining a safe driving record (for auto insurance) is essential. Accidents and traffic violations lead to increased premiums. Defensive driving and adherence to traffic laws can keep your costs down.

Finally, review your coverage regularly. Your needs may change over time, and you may find you’re paying for coverage you no longer require. Adjusting your coverage accordingly can lead to substantial savings.