Building a high-yield investment portfolio requires careful planning and a strategic approach. This comprehensive guide will walk you through the essential steps to crafting a portfolio designed for maximum returns, covering topics such as diversification, risk management, and selecting high-yield investments like dividend stocks, bonds, and real estate. Learn how to optimize your investment strategy for significant income generation and long-term wealth growth while mitigating potential risks. Discover the secrets to building a robust and profitable portfolio tailored to your individual financial goals and risk tolerance.

Understanding High-Yield Investments

High-yield investments, also known as high-income investments or fixed-income securities, offer the potential for above-average returns compared to traditional investments like bonds or savings accounts. These investments often come with a higher level of risk, however.

Examples of high-yield investments include high-yield corporate bonds (also called “junk bonds”), preferred stocks, certain real estate investment trusts (REITs), and dividend-paying stocks with high yields. The higher yield is typically offered to compensate investors for the increased risk of default or lower credit ratings.

It’s crucial to understand that while the potential for higher returns is attractive, higher risk is inherent. High-yield investments can be more volatile and susceptible to market downturns. A thorough understanding of your risk tolerance and diversification strategy is essential before investing in high-yield options.

Diversification is a key factor in mitigating risk. Don’t put all your eggs in one basket. Spread your investments across various asset classes and high-yield opportunities to reduce the impact of any single investment performing poorly.

Due diligence is paramount. Before investing in any high-yield instrument, carefully research the issuer’s financial stability and creditworthiness. Understanding the underlying risks associated with each investment is vital for making informed decisions.

Diversification Strategies for Maximum Returns

Diversification is crucial for maximizing returns and minimizing risk in any investment portfolio. A well-diversified portfolio spreads investments across different asset classes, reducing the impact of poor performance in any single area. Asset allocation is a key component, involving the strategic distribution of your capital among stocks, bonds, real estate, and alternative investments like commodities or private equity.

Within each asset class, further diversification is essential. For example, instead of investing solely in a single stock, a diversified equity portfolio would include a range of stocks across different sectors (technology, healthcare, finance, etc.) and market capitalizations (large-cap, mid-cap, small-cap). Similarly, bond diversification involves holding bonds with varying maturities, credit ratings, and issuers.

Geographic diversification is another important strategy, spreading investments across different countries and regions to mitigate risks associated with specific economic or political events in a single location. This reduces exposure to currency fluctuations and geopolitical uncertainty.

Finally, consider tactical diversification, adjusting your portfolio based on market conditions and your risk tolerance. This might involve increasing your allocation to bonds during periods of market volatility or shifting towards growth stocks during economic expansions. Regular portfolio reviews and rebalancing are key to maintaining a diversified and high-yielding investment strategy.

Balancing Risk and Reward in Your Portfolio

Building a high-yield investment portfolio requires a delicate balance between risk and reward. Higher potential returns often come with increased risk of loss. Understanding your personal risk tolerance is crucial.

Risk tolerance is your comfort level with the possibility of losing money. A conservative investor might prefer lower-risk investments like government bonds, even if they offer lower yields. A more aggressive investor might allocate a larger portion of their portfolio to higher-risk, higher-reward assets such as stocks or real estate.

Diversification is key to mitigating risk. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the impact of any single investment’s poor performance. A well-diversified portfolio can help achieve a higher yield without taking on excessive risk.

Regularly rebalancing your portfolio is also important. As market conditions change, the allocation of your assets might drift from your target. Rebalancing involves selling some assets that have performed well and buying others that have underperformed, bringing your portfolio back to your desired risk-reward balance.

Finally, professional advice can be invaluable. A financial advisor can help you assess your risk tolerance, create a diversified portfolio, and develop a long-term investment strategy tailored to your specific financial goals.

Top High-Yield Investment Options

Building a high-yield investment portfolio requires careful consideration of various asset classes. High-yield bonds, also known as junk bonds, offer the potential for higher returns than investment-grade bonds but carry significantly more risk. Their higher yields compensate for the increased default risk.

Dividend-paying stocks can provide a steady stream of income. However, dividend payments are not guaranteed and can be reduced or eliminated if a company’s financial performance deteriorates. Careful selection of financially stable companies with a history of consistent dividend payouts is crucial.

Real estate investment trusts (REITs) invest in income-producing real estate and often pay high dividends. REITs can offer diversification benefits and relatively stable income, but their value can fluctuate significantly based on market conditions and interest rates.

Preferred stocks offer a hybrid investment combining characteristics of both stocks and bonds. They typically pay higher dividends than common stocks but offer less potential for capital appreciation. The stability of the dividend depends on the issuing company’s financial health.

Peer-to-peer (P2P) lending involves lending money directly to borrowers through online platforms. While potentially offering high returns, it also carries considerable risk due to the possibility of borrower defaults. Thorough due diligence is essential.

It is crucial to remember that higher yields often come with higher risks. Diversification across different asset classes is key to mitigating risk and achieving a balanced portfolio that aligns with your individual risk tolerance and investment goals. Consulting a financial advisor is recommended before making any significant investment decisions.

How to Analyze Market Trends

Analyzing market trends is crucial for building a high-yield investment portfolio. Understanding these trends allows you to make informed decisions about asset allocation and timing of investments.

Begin by identifying key economic indicators such as inflation rates, interest rates, and GDP growth. These provide a broad overview of the overall economic health and potential market direction. Follow industry-specific news and reports to understand sector-specific performance and future prospects.

Technical analysis, using charts and graphs to identify patterns and trends, can complement fundamental analysis. Look for support and resistance levels, as well as moving averages to gauge momentum.

Fundamental analysis involves examining a company’s financial statements to assess its intrinsic value. This includes evaluating its earnings, revenue growth, debt levels, and competitive advantage. Comparing these factors to market valuation helps determine if a stock is undervalued or overvalued.

Finally, consider global events and geopolitical factors, as these can significantly influence market performance. Staying informed about these developments is essential for proactive portfolio management.

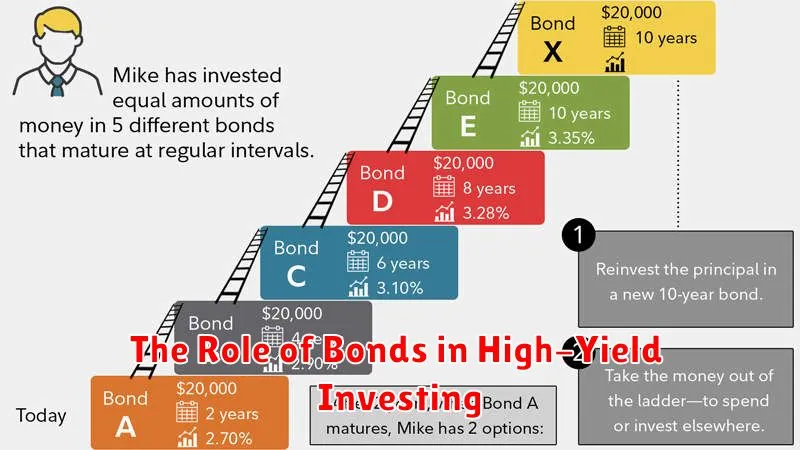

The Role of Bonds in High-Yield Investing

While stocks are often the primary focus in high-yield investing, bonds play a crucial, albeit often overlooked, role in portfolio diversification and risk management. High-yield bonds, also known as junk bonds, offer the potential for higher returns than investment-grade bonds due to their higher risk.

Including bonds, particularly high-yield options, in a high-yield portfolio helps to diversify risk. The inverse correlation between stocks and bonds means that when stock prices decline, bond prices may rise, thus cushioning the overall portfolio against significant losses. This diversification can lead to a smoother investment journey, reducing volatility.

However, it’s crucial to understand the increased risk associated with high-yield bonds. The higher yield is a reflection of the increased probability of default. Careful selection of bonds based on credit rating and issuer analysis is vital to mitigate this risk. Due diligence is essential to avoid substantial losses.

The ideal allocation of bonds within a high-yield portfolio depends on individual risk tolerance and investment goals. A well-balanced approach typically involves a mix of stocks and bonds, allowing investors to customize their exposure to risk and potential reward. Professional financial advice can be valuable in determining the appropriate allocation.

Managing Portfolio Volatility

High-yield investments often come with increased volatility. Diversification is key to mitigating this risk. Spread your investments across different asset classes (e.g., stocks, bonds, real estate) and sectors to reduce the impact of any single investment’s poor performance.

Asset allocation plays a crucial role. Determine your risk tolerance and allocate assets accordingly. A more conservative approach might involve a larger percentage in lower-risk, lower-yield investments, while a more aggressive strategy might accept higher volatility in pursuit of higher returns. Regularly rebalance your portfolio to maintain your target allocation.

Dollar-cost averaging is a valuable strategy to manage volatility. Instead of investing a lump sum, invest smaller amounts at regular intervals. This approach reduces the impact of market fluctuations on your overall investment.

Time horizon is a significant factor. If you have a longer time horizon, you can generally tolerate more volatility as you have more time to recover from market downturns. Conversely, shorter-term investors should prioritize stability and potentially accept lower yields.

Finally, consider using stop-loss orders to limit potential losses on individual investments. This protective measure helps to prevent significant drawdowns during periods of market volatility.

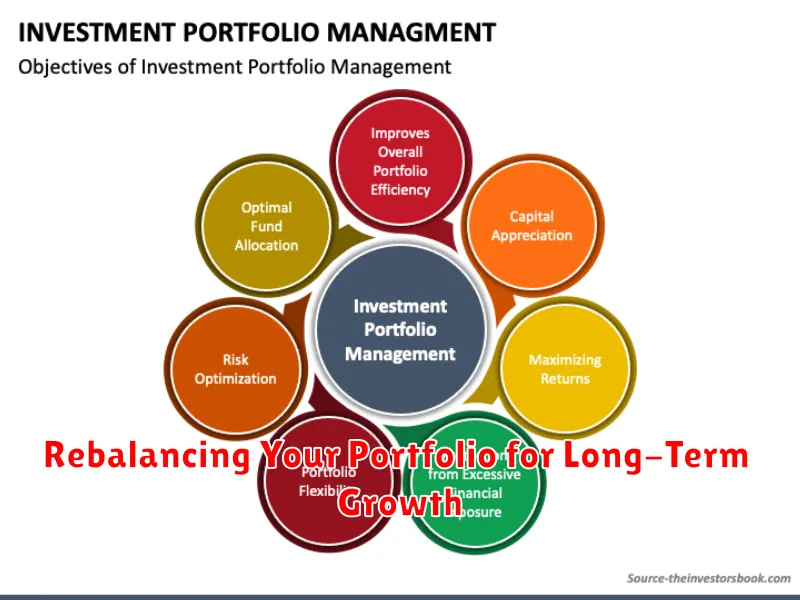

Rebalancing Your Portfolio for Long-Term Growth

Rebalancing your investment portfolio is crucial for long-term growth and risk management. It involves periodically adjusting your asset allocation to maintain your desired target percentages across different asset classes (e.g., stocks, bonds, real estate).

As market conditions fluctuate, some investments will outperform others, causing your portfolio to drift from its original allocation. Rebalancing involves selling some of the assets that have grown beyond their target allocation and reinvesting the proceeds into those that have fallen below their targets.

This process helps to maintain a disciplined investment strategy and reduces the risk of overexposure to any single asset class. By taking profits from winners and reinvesting in underperformers, you capitalize on market fluctuations while mitigating potential losses. Regular rebalancing, typically annually or semi-annually, is key to achieving a sustainable, long-term growth strategy.

Consistent rebalancing helps to manage risk, ensuring your portfolio remains aligned with your risk tolerance and financial goals. It also prevents emotional decision-making, a common pitfall for investors who may be tempted to chase past performance.

The specific rebalancing frequency depends on individual circumstances and investment goals. However, establishing a regular schedule and sticking to it is vital for successful long-term investment growth.