Financial literacy is paramount in achieving wealth management success. Understanding personal finance, including budgeting, investing, and debt management, is crucial for building and protecting wealth. This article explores the importance of financial literacy in navigating the complexities of wealth management and achieving your financial goals.

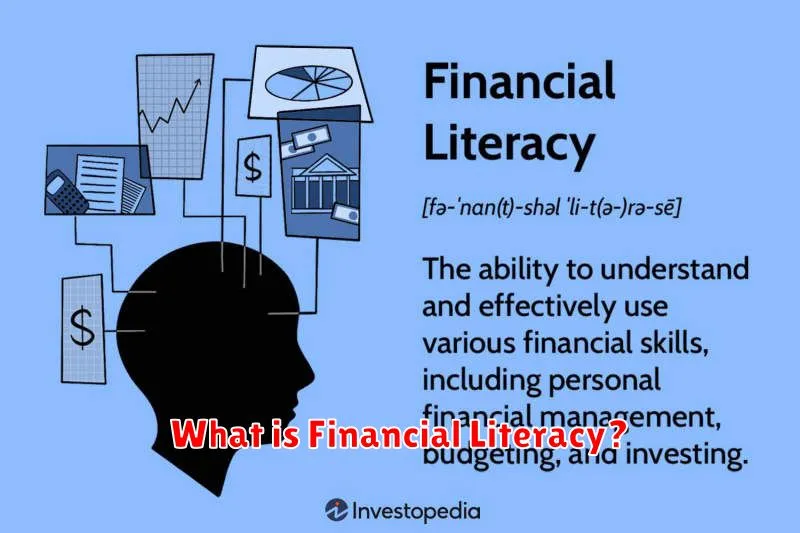

What is Financial Literacy?

Financial literacy is the possession of the knowledge and skills necessary to make informed financial decisions. It encompasses a wide range of concepts, including budgeting, saving, investing, debt management, and understanding financial products and services.

Essentially, financial literacy empowers individuals to effectively manage their money, achieve their financial goals, and build long-term financial security. It’s about understanding how money works and making conscious choices to improve one’s financial well-being.

A financially literate individual can confidently navigate various financial situations, from planning for retirement to making sound borrowing decisions. This includes understanding interest rates, credit scores, insurance, taxes, and investment strategies.

Why Everyone Should Understand Basic Finance

Financial literacy is not merely beneficial; it’s essential for navigating modern life. Understanding basic finance empowers individuals to make informed decisions about their money, leading to improved financial well-being.

A grasp of fundamental concepts like budgeting, saving, and investing allows for better control over personal finances. This knowledge helps individuals avoid debt traps, plan for long-term goals (such as retirement or homeownership), and make sound choices regarding credit and insurance.

Furthermore, basic financial understanding equips individuals to identify and avoid financial scams and predatory lending practices. It fosters financial independence and provides the tools to build and protect wealth over time. In essence, mastering basic finance is a crucial life skill that enhances overall quality of life.

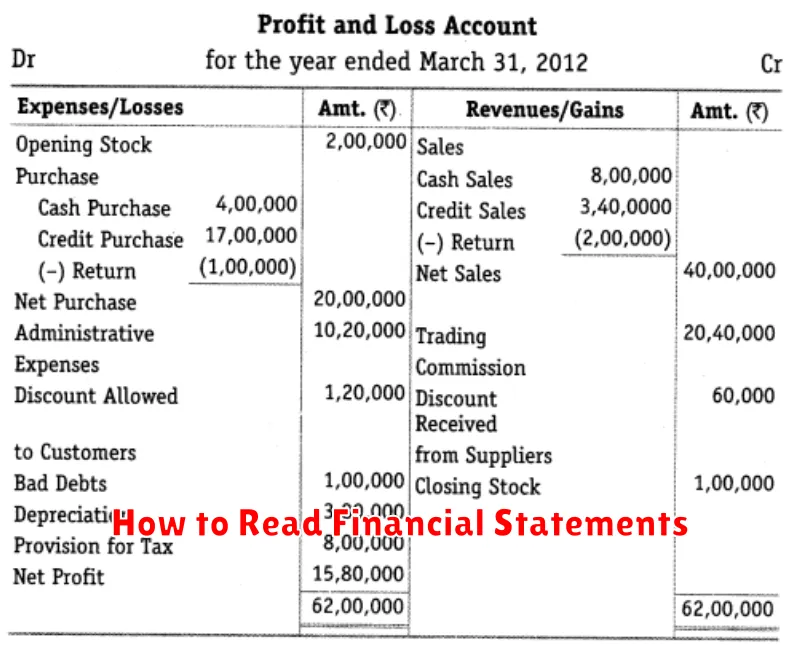

How to Read Financial Statements

Understanding financial statements is crucial for effective wealth management. Financial statements, primarily the balance sheet, income statement, and cash flow statement, provide a snapshot of a company’s or individual’s financial health.

The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. It follows the fundamental accounting equation: Assets = Liabilities + Equity. Understanding this equation is key to interpreting the balance sheet.

The income statement, also known as the profit and loss statement, reports a company’s revenues and expenses over a period of time, resulting in net income or net loss. Analyzing the income statement reveals profitability and trends in revenue and expenses.

The cash flow statement tracks the movement of cash both into and out of a company over a period. It categorizes cash flows into operating, investing, and financing activities. This statement is vital for assessing a company’s liquidity and solvency.

To effectively read financial statements, focus on key ratios and metrics such as profitability ratios (e.g., gross profit margin, net profit margin), liquidity ratios (e.g., current ratio, quick ratio), and solvency ratios (e.g., debt-to-equity ratio). These ratios offer valuable insights into a company’s financial performance and risk profile.

While interpreting financial statements requires some accounting knowledge, focusing on the core concepts and key ratios provides a strong foundation for making informed financial decisions. Professional advice from a financial advisor may be beneficial for complex situations.

The Impact of Financial Education on Wealth Growth

Financial education plays a crucial role in wealth accumulation. Individuals with a strong understanding of personal finance principles, such as budgeting, saving, investing, and debt management, are better equipped to make informed decisions that lead to increased wealth.

Effective financial planning, a direct result of financial education, enables individuals to set realistic financial goals, track their progress, and adjust their strategies as needed. This proactive approach significantly improves the likelihood of achieving long-term financial security.

Moreover, financial education empowers individuals to navigate complex financial products and services more effectively. Understanding concepts like compound interest, risk diversification, and asset allocation allows for more strategic investing and wealth growth. This reduces the risk of costly financial mistakes and maximizes returns.

Ultimately, the impact of financial education on wealth growth is substantial. By fostering informed decision-making and proactive financial planning, it provides individuals with the tools and knowledge necessary to build and preserve their wealth over time.

Best Online Courses for Financial Literacy

Financial literacy is crucial for effective wealth management. Fortunately, numerous online courses cater to different learning styles and experience levels. Here are some of the best:

Coursera and edX offer a wide selection of courses from reputable universities, covering topics such as budgeting, investing, and debt management. Many courses are free to audit, allowing learners to access course materials without paying for certification.

Khan Academy provides free, comprehensive resources on personal finance, including videos and interactive exercises. Their focus on clear explanations makes it ideal for beginners.

Investopedia Academy offers specialized courses for investors, covering topics like stock analysis and portfolio building. While some courses are paid, they provide in-depth knowledge for those seeking advanced financial skills.

Skillshare and Udemy host a variety of financial literacy courses, often taught by industry professionals. Their courses vary in price and focus, offering a diverse range of options for learners of all backgrounds.

Choosing the best online course depends on individual learning preferences and goals. Consider your current knowledge level, desired learning depth, and budget when selecting a course.

How to Teach Financial Literacy to Kids

Teaching children about finances early is crucial for their future wealth management. Start young, even with preschoolers, using age-appropriate methods. For toddlers, focus on concepts like needs versus wants. Use visual aids like piggy banks to demonstrate saving.

As kids get older (elementary school), introduce the concept of earning money through chores and allowances. Connect this to saving and spending, perhaps using a three-jar system: one for saving, one for spending, and one for giving. Emphasize the importance of delayed gratification.

In middle school, children can learn about budgeting and the value of investing. Explain simple investing concepts like stocks and bonds using age-appropriate examples. Encourage them to track their spending and saving goals. Consider opening a savings account in their name.

High school is a great time to explore more complex topics like credit cards, loans, and taxes. Teach them the importance of building good credit and the dangers of high-interest debt. Help them understand basic tax concepts and the importance of financial planning for the future.

Throughout this process, open communication and real-world examples are key. Make learning fun and engaging. Answer their questions honestly and patiently. Financial literacy is a journey, not a destination, and consistent teaching will empower them for a secure financial future.

Understanding Interest Rates and Loans

Interest rates are the cost of borrowing money. They are expressed as a percentage of the principal amount borrowed and represent the lender’s compensation for the risk of lending. Understanding how interest rates work is crucial for effective financial management.

Loans come in various forms, each with its own terms and interest rate. These can include mortgages, auto loans, personal loans, and student loans. The interest rate on a loan depends on several factors, including the borrower’s creditworthiness, the loan amount, the loan term, and prevailing market interest rates.

Compound interest is a key concept. It means that interest is calculated not only on the principal but also on accumulated interest. This can significantly increase the total amount owed over the life of a loan, highlighting the importance of paying down debt promptly.

Annual Percentage Rate (APR) is a crucial metric to consider when comparing loan offers. The APR incorporates the interest rate plus any associated fees, providing a comprehensive picture of the true cost of borrowing.

Financial literacy empowers individuals to make informed decisions about borrowing. Understanding interest rates and loan terms helps avoid costly mistakes and enables better management of personal finances, leading to improved long-term financial well-being.

Steps to Become More Financially Literate

Improving your financial literacy is a crucial step towards effective wealth management. It involves understanding and managing your personal finances effectively. Here are some key steps to enhance your financial knowledge:

Track your spending: Begin by monitoring where your money goes. Utilize budgeting apps or spreadsheets to gain a clear picture of your income and expenses. This provides the foundation for informed financial decisions.

Create a budget: Based on your spending analysis, develop a realistic budget that allocates funds for essential needs, wants, and savings. Prioritize needs and strategically limit non-essential spending.

Set financial goals: Define clear, achievable short-term and long-term goals, such as paying off debt, saving for a down payment, or planning for retirement. This gives your financial planning direction and purpose.

Learn about investing: Understand basic investment concepts, including diversification, risk tolerance, and different investment vehicles. Start with accessible resources like books and online courses to build a foundation.

Seek professional advice: Consult with a qualified financial advisor for personalized guidance, particularly when dealing with complex financial matters like retirement planning or estate management. A professional can provide tailored strategies.

Continuously educate yourself: Financial literacy is an ongoing process. Stay updated on financial trends, regulations, and best practices through reliable sources such as reputable financial websites and publications.

By consistently implementing these steps, you can significantly improve your financial literacy and pave the way for more effective wealth management.