Achieving financial independence at a young age is a compelling goal, offering the freedom to pursue passions, spend time with loved ones, and enjoy life on your own terms. This guide explores practical strategies to accelerate your path towards early retirement, covering topics such as budgeting, investing, and debt management. Learn how to build a robust financial plan, maximize your savings, and make smart investment decisions to secure your financial future and achieve early financial freedom.

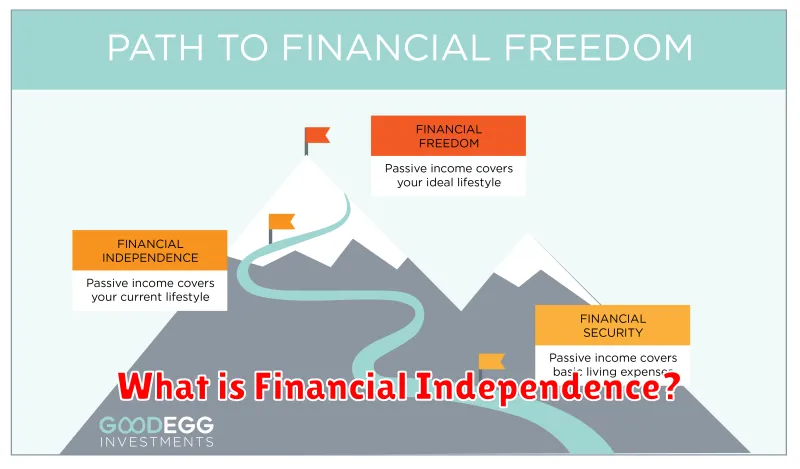

What is Financial Independence?

Financial independence (FI) is the state of having enough passive income to cover your living expenses without needing to work actively for money. This doesn’t necessarily mean being a millionaire; it’s about having your investments generate sufficient returns to support your lifestyle. The key is achieving a sustainable balance between your income and expenses, allowing for freedom and flexibility in life choices.

It’s crucial to differentiate FI from wealth. While wealth accumulation is often a component of achieving FI, it’s not the defining factor. Someone could be financially independent with a modest portfolio if their living expenses are low. Ultimately, financial independence is about financial freedom—the ability to choose how you spend your time and pursue your passions without being constrained by financial obligations.

Building Multiple Streams of Income

Financial independence at an early age often hinges on building multiple streams of income. This diversification mitigates risk and accelerates wealth accumulation. Instead of relying solely on a single job or income source, consider diversifying your earnings.

One approach is to develop a passive income stream. This could involve creating and selling online courses, writing and publishing ebooks, or investing in rental properties. These ventures generate income with minimal ongoing effort once established.

Another strategy is to cultivate multiple active income streams. This might include freelancing, consulting, or taking on part-time jobs in your area of expertise. These activities require more direct involvement but can generate immediate cash flow.

Careful planning and management are crucial. Identify your skills and interests to find income streams that align with your capabilities and passions. Track your income and expenses diligently to ensure profitability and effective resource allocation. By strategically building multiple income streams, you accelerate your path to early financial independence.

How to Live Below Your Means

Living below your means is a cornerstone of achieving early financial independence. It’s about intentionally spending less than you earn, allowing you to save and invest more aggressively.

Track your spending: Use budgeting apps or spreadsheets to meticulously monitor where your money goes. This reveals areas for potential savings.

Identify non-essential expenses: Scrutinize your spending habits. Are there subscriptions you don’t use? Can you reduce dining out or entertainment costs? These seemingly small expenses accumulate significantly over time.

Prioritize needs over wants: Distinguish between necessities (housing, food, transportation) and wants (luxury items, frequent shopping). Focus your spending on needs first.

Embrace a minimalist lifestyle: A minimalist approach emphasizes owning fewer possessions, reducing clutter and, consequently, spending. This can significantly lower expenses related to storage, maintenance, and impulse purchases.

Negotiate and comparison shop: Don’t hesitate to negotiate bills, such as internet or insurance. Compare prices before making any significant purchase to ensure you’re getting the best value.

Set financial goals: Having clear financial goals, like early retirement or a down payment on a house, provides strong motivation to stick to your budget and live below your means.

Automate savings: Set up automatic transfers from your checking account to your savings or investment accounts. This ensures consistent saving even before you have a chance to spend the money.

Consistency is key: Living below your means isn’t a sprint; it’s a marathon. Consistent effort and discipline are crucial for long-term success and achieving your financial independence goals.

The Power of Compound Interest

Achieving early financial independence hinges on understanding and leveraging the power of compound interest. This principle, often called the “eighth wonder of the world,” involves earning interest not only on your initial investment (principal) but also on the accumulated interest itself.

The earlier you start investing, the more time your money has to grow exponentially. Even small, regular contributions can yield significant returns over the long term due to the compounding effect. Time is your most valuable asset in this process.

Consider this: a small initial investment earning a modest annual return, compounded over several decades, can grow into a substantial sum. This exponential growth is the key to building wealth and achieving financial independence much sooner than you might think. The magic of compounding allows your money to work for you, generating wealth passively.

To maximize the benefits of compound interest, focus on consistent investing and long-term growth. Avoid frequent withdrawals and consider investing in assets with historically higher returns, while carefully managing risk. The longer you let your investments compound, the greater the eventual payoff.

Smart Investing for Early Retirement

Achieving early retirement requires a robust investment strategy. This involves carefully considering your risk tolerance, time horizon, and financial goals. Diversification is key to mitigating risk; consider a mix of stocks, bonds, and potentially real estate or alternative investments.

Index funds and ETFs offer low-cost, diversified exposure to the market, making them attractive options for long-term investors aiming for early retirement. Dollar-cost averaging, a strategy of investing a fixed amount regularly regardless of market fluctuations, can help mitigate risk and emotionally driven decisions.

Tax-advantaged accounts such as 401(k)s and IRAs are crucial for maximizing your investment returns. Understanding the tax implications of different investment vehicles is essential for optimizing your long-term financial picture. Regularly reviewing and rebalancing your portfolio ensures it remains aligned with your goals and risk tolerance as your circumstances change.

Finally, consistent saving and disciplined investing are paramount. While there’s no magic bullet, a well-structured investment plan, coupled with a commitment to saving, significantly increases your chances of achieving financial independence and early retirement.

Side Hustles and Passive Income Ideas

Achieving early financial independence often requires supplementing your primary income. Side hustles offer a direct path to boosting your earnings. Consider skills-based options like freelance writing, graphic design, or virtual assistance, leveraging your existing expertise for immediate income. Explore platforms connecting freelancers with clients for easy access to opportunities.

Passive income streams, while requiring upfront effort, generate income with minimal ongoing work. Examples include creating and selling online courses, building a niche blog and monetizing it through advertising or affiliate marketing, or investing in dividend-paying stocks or real estate. The key is to identify a sustainable model that aligns with your skills and interests, then dedicate the initial time and energy needed to establish it.

A well-structured approach combines both active and passive income strategies. Begin by focusing on a few high-impact side hustles that generate quick returns to build a financial foundation. Simultaneously, start developing one or two passive income streams; this will build a longer-term income engine that contributes to your financial independence goals over time.

Avoiding Debt While Growing Wealth

Achieving early financial independence requires a strategic approach to both saving and avoiding debt. High-interest debt, such as credit card debt, can significantly hinder wealth accumulation. Prioritize paying off existing high-interest debt before aggressively investing.

Budgeting is crucial. Track your income and expenses to identify areas where you can reduce spending and allocate more towards savings and investments. Creating a realistic budget allows you to consciously choose between wants and needs, preventing unnecessary debt.

Smart spending habits are essential. Avoid impulse purchases and unnecessary expenses. Consider delaying gratification to save for larger purchases instead of relying on credit. Focus on building a strong financial foundation before pursuing luxury items.

Investing wisely is key to wealth growth. Explore diverse investment options like index funds or ETFs to diversify risk and potentially maximize returns over the long term. Consult with a financial advisor to develop a personalized investment strategy.

By combining diligent debt avoidance with consistent saving and strategic investing, you can build wealth efficiently and accelerate your path towards early financial independence. Remember, financial discipline is paramount in this process.

How to Stay Financially Disciplined

Maintaining financial discipline is crucial for achieving early financial independence. It requires a conscious effort to manage your money effectively and resist impulsive spending.

Budgeting is paramount. Create a detailed budget that tracks your income and expenses, allowing you to identify areas where you can save. Utilize budgeting apps or spreadsheets to streamline the process.

Track your spending diligently. Monitor your transactions regularly to identify unnecessary expenses and adjust your spending habits accordingly. This awareness fosters responsible financial behavior.

Set realistic financial goals. Define short-term and long-term goals, providing direction and motivation for your financial journey. Breaking down large goals into smaller, achievable steps makes the process less daunting.

Automate savings. Set up automatic transfers from your checking account to your savings and investment accounts. This ensures consistent contributions, even when you’re busy or tempted to spend.

Avoid unnecessary debt. High-interest debt can significantly hinder your progress towards financial independence. Prioritize paying down existing debt and avoid accumulating new debt unless absolutely necessary.

Develop a saving plan. Consider various savings vehicles like high-yield savings accounts or investment accounts based on your risk tolerance and financial goals.

Regularly review your financial plan. Life circumstances change, so periodically review your budget, goals, and savings strategies to ensure they align with your current situation. Adjustments might be needed to stay on track.

Seek professional advice when needed. A financial advisor can provide personalized guidance and support, helping you create a robust financial plan tailored to your specific needs.