Are you struggling with debt and seeking financial stability? Effective debt management is crucial for achieving long-term financial success. This article explores proven strategies to help you conquer your debt, improve your credit score, and build a secure financial future. Learn how to create a budget, prioritize your debts, negotiate with creditors, and develop healthy financial habits for lasting financial stability. Discover the path to debt freedom and a brighter financial tomorrow.

Understanding Different Types of Debt

Effective debt management starts with understanding the various types of debt you may have. Knowing the characteristics of each allows for better strategic repayment planning.

Secured Debt is backed by collateral, meaning a lender can seize an asset (like a house or car) if you default. Examples include mortgages and auto loans.

Unsecured Debt is not backed by collateral. Defaulting on unsecured debt can severely damage your credit score. Examples include credit cards, personal loans, and medical bills.

Good Debt, often used for investments that appreciate in value, can contribute to long-term financial growth. Examples might include student loans (leading to higher earning potential) or a mortgage (building equity in a home).

Bad Debt typically accrues high interest rates and offers little to no return on investment. Examples include high-interest credit cards, payday loans, and some types of personal loans.

Revolving Credit allows you to borrow and repay funds repeatedly up to a pre-set limit. Credit cards are the most common example.

Installment Credit requires fixed monthly payments over a set period. Auto loans and mortgages are examples.

Understanding these distinctions helps prioritize repayment strategies and manage your financial health effectively.

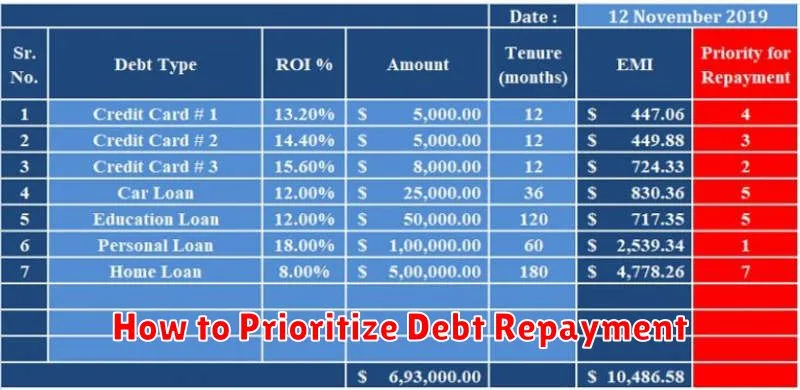

How to Prioritize Debt Repayment

Effective debt management hinges on a strategic repayment plan. Prioritizing which debts to tackle first significantly impacts your progress and overall financial health. Two popular methods exist: the debt avalanche and the debt snowball method.

The debt avalanche method focuses on paying off the debt with the highest interest rate first. While slower initially for smaller debts, it saves you the most money in the long run by minimizing interest accrual. This approach is mathematically optimal.

Conversely, the debt snowball method prioritizes paying off the smallest debt first, regardless of interest rate. This method offers a psychological advantage, providing early wins that build momentum and motivation. The feeling of accomplishment can encourage consistent repayment.

Choosing the best method depends on your individual circumstances and personality. Consider your financial goals, risk tolerance, and psychological needs when deciding which strategy aligns best with your approach to debt repayment. Consistency in repayment is key, regardless of the chosen method.

The Snowball vs Avalanche Method

Two popular methods for tackling debt are the snowball and avalanche methods. Both aim to eliminate debt, but they differ in their approach.

The snowball method prioritizes paying off the smallest debts first, regardless of interest rate. The psychological boost from quickly eliminating debts motivates continued effort. This method is best for those who need a quick win to maintain momentum.

Conversely, the avalanche method focuses on paying off debts with the highest interest rates first. While it may take longer to see initial progress, it ultimately saves more money on interest in the long run. This is the more financially efficient approach.

Choosing between the two depends on individual circumstances and personality. The snowball method offers motivational advantages, while the avalanche method provides the greatest financial savings. Consider your priorities and choose the strategy that best aligns with your goals and resilience.

Negotiating with Creditors

Negotiating with creditors can be a crucial step in effective debt management. It involves directly contacting your creditors to discuss your financial situation and propose alternative repayment plans. Preparation is key; gather all relevant financial documents before contacting them.

When you contact your creditors, clearly explain your financial hardship. Be honest and provide specific details about your income and expenses. Propose a realistic and written repayment plan, perhaps suggesting a lower monthly payment or a temporary suspension of payments. Be prepared to negotiate and compromise.

Consider consolidating your debts to simplify payments and potentially secure a lower interest rate. This may involve taking out a personal loan to pay off existing debts or using a balance transfer credit card. However, carefully compare interest rates and fees before making a decision.

If negotiations fail, explore options like debt management plans (DMPs) offered by credit counseling agencies. These plans work with creditors to reduce monthly payments and potentially lower interest rates. Remember that seeking professional financial advice can greatly assist in navigating these complex situations.

It’s vital to maintain open and consistent communication with your creditors throughout the negotiation process. Missed payments or a lack of communication can hinder your efforts and potentially damage your credit score further. Thorough planning and respectful communication are vital for successful debt negotiation.

Debt Consolidation: Pros and Cons

Debt consolidation involves combining multiple debts into a single payment. This strategy offers several potential advantages. A major pro is simplification; managing one payment is easier than juggling many. This can lead to improved organization and reduced risk of missed payments. Furthermore, a consolidated loan might offer a lower interest rate, resulting in lower monthly payments and faster debt repayment. Finally, it can improve your credit score over time, provided you make consistent payments.

However, debt consolidation also presents disadvantages. A significant con is the potential for a longer repayment period, especially if you opt for a lower monthly payment. This can ultimately lead to paying more interest overall. Additionally, some consolidation options require collateral, putting your assets at risk if you default. The process of consolidating debt can also be time-consuming and complex, requiring significant effort to organize and apply for a new loan. Lastly, if not managed carefully, debt consolidation can mask the underlying spending habits that led to the initial debt accumulation, potentially leading to future debt problems.

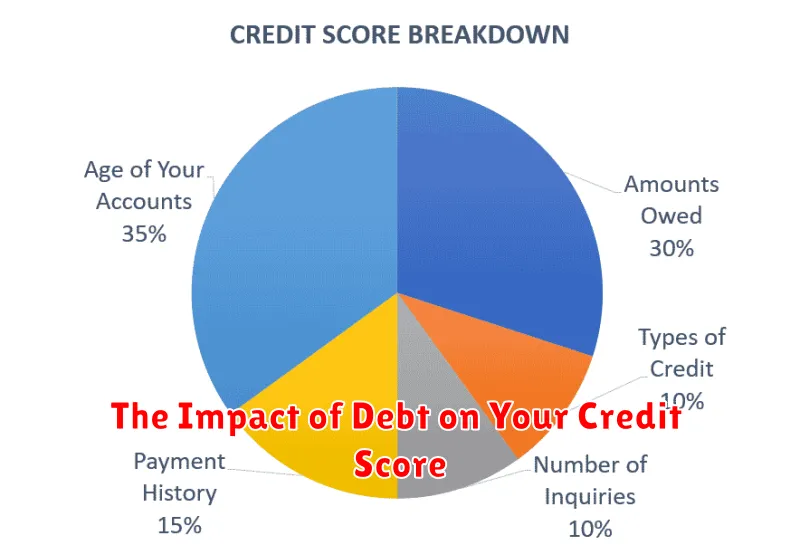

The Impact of Debt on Your Credit Score

Your credit score is a crucial number that significantly impacts your financial life. It reflects your creditworthiness and influences your ability to secure loans, rent an apartment, or even get a job. Debt plays a major role in shaping this score.

The amount of debt you owe, relative to your available credit (your credit utilization ratio), is a key factor. A high utilization ratio (e.g., using 80% of your credit limit) negatively impacts your score. Conversely, keeping your utilization low (ideally below 30%) signals responsible credit management.

The types of debt also matter. While some debt, like a mortgage, can improve your score if managed well, high-interest debt like credit card balances can significantly damage it. Late payments are particularly detrimental, even one missed payment can have a substantial negative impact.

Length of credit history also influences your score. Older accounts demonstrate a consistent history of responsible credit management, while consistently opening new accounts can temporarily lower your score. Therefore, effective debt management is critical for maintaining a strong credit score and achieving long-term financial stability.

How to Avoid Accumulating More Debt

Budgeting is crucial. Create a detailed budget tracking all income and expenses to identify areas where spending can be reduced. This allows for better allocation of funds and prevents overspending.

Prioritize needs over wants. Differentiate between essential expenses (housing, food, utilities) and non-essential spending (entertainment, dining out). Curtail unnecessary purchases to free up funds for debt repayment.

Emergency fund is a safety net. Having 3-6 months of living expenses saved prevents borrowing for unexpected events like medical bills or car repairs.

Mindful spending habits are key. Avoid impulse buys and practice delayed gratification. Before making a purchase, consider if it’s truly necessary and if you can afford it without impacting your budget.

Debt consolidation can simplify repayment. Combining multiple debts into a single loan with a lower interest rate can make managing and paying off debt easier.

Seek professional advice if needed. A financial advisor can provide personalized guidance and strategies to manage debt effectively and prevent future accumulation.

Steps to Achieve a Debt-Free Life

Achieving a debt-free life requires a structured approach and unwavering commitment. Begin by creating a detailed budget, meticulously tracking all income and expenses. This provides a clear picture of your financial situation and identifies areas for potential savings.

Next, prioritize your debts. Consider employing strategies like the debt snowball (paying off the smallest debts first for motivation) or the debt avalanche (paying off the highest-interest debts first for long-term savings). Focus on making more than the minimum payments on your debts whenever possible.

Increase your income through additional work, freelancing, or selling unused assets. Every extra dollar contributes to faster debt reduction. Simultaneously, explore ways to reduce expenses. Cut back on non-essential spending and find more affordable alternatives for necessities.

Seek professional help if needed. A financial advisor can offer personalized guidance and strategies tailored to your specific situation. Maintain a positive mindset and celebrate small milestones along the way to stay motivated throughout this challenging but rewarding journey.

Finally, establish good financial habits once your debt is cleared. This includes maintaining a healthy savings rate, creating an emergency fund, and sticking to a budget to prevent future debt accumulation. Consistency and discipline are key to lasting financial freedom.