Financial planning for millennials is no longer a luxury but a necessity. This comprehensive guide tackles the unique financial challenges faced by young adults, offering practical strategies for building wealth, managing debt, and securing a strong financial future. Learn how to navigate student loan repayment, investing for the long term, and planning for major life events like homeownership and retirement, all while maximizing your earning potential and minimizing financial stress. Discover actionable steps to achieve your financial goals and build a secure and prosperous future.

Why Financial Planning is Essential for Millennials

Millennials face unique financial challenges, including student loan debt, a competitive job market, and rising living costs. Effective financial planning is crucial to navigate these obstacles and build a secure future.

Early planning allows millennials to maximize the power of compound interest, leading to significant long-term wealth accumulation. Starting early enables them to invest more aggressively and potentially recover from market downturns more easily.

A well-defined financial plan helps millennials achieve their long-term goals, such as buying a home, starting a family, or retiring comfortably. It provides a roadmap for making informed decisions about saving, investing, and spending.

Financial planning reduces financial stress and anxiety. Having a clear understanding of one’s finances and a plan to achieve financial goals instills confidence and peace of mind.

Furthermore, a comprehensive financial plan allows millennials to prepare for unexpected events, such as job loss or medical emergencies. Having an emergency fund and appropriate insurance coverage are essential components of mitigating risk.

How to Budget and Save on a Limited Income

Budgeting on a limited income requires discipline and strategic planning. The first step is to track your spending for a month to understand where your money goes. Categorize expenses (housing, food, transportation, etc.) to identify areas for potential cuts.

Next, create a realistic budget. Prioritize essential expenses like rent and utilities. Explore ways to reduce non-essential spending, such as dining out or entertainment. Consider using budgeting apps to simplify the process and monitor progress.

Finding ways to increase income is crucial. Explore opportunities like a side hustle, freelance work, or selling unused items. Even small increases can significantly impact your savings.

Saving should be a part of your budget, even if it’s a small amount. Automate savings by setting up recurring transfers from your checking to savings account. Consider setting up a high-yield savings account to maximize returns.

Review and adjust your budget regularly. Life changes, so your budget should adapt accordingly. Be flexible and patient, building a strong financial foundation takes time.

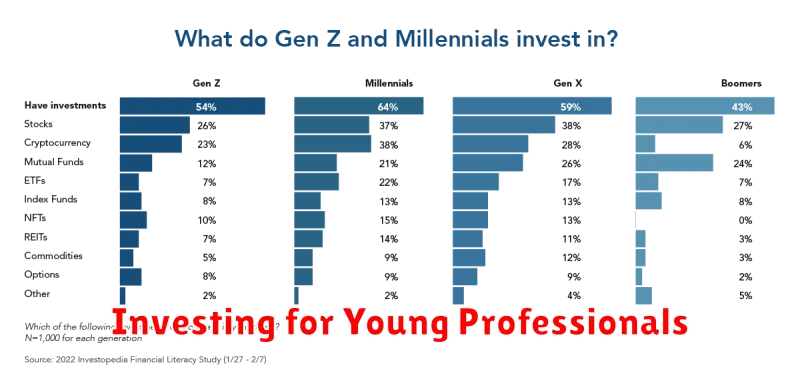

Investing for Young Professionals

Investing early is crucial for young professionals aiming to build long-term wealth. Starting sooner allows for the power of compounding, where returns generate further returns over time. Even small, consistent contributions can significantly impact your future financial security.

A diversified investment portfolio is essential. Consider a mix of low-cost index funds or exchange-traded funds (ETFs) that track broad market indices, offering diversification across various sectors and asset classes. This approach minimizes risk compared to investing in individual stocks.

Retirement accounts such as 401(k)s and IRAs offer tax advantages that can significantly boost your investment growth. Maximize employer matching contributions in your 401(k) to leverage free money. Understand the different types of IRAs (Traditional and Roth) to determine the best fit for your individual tax situation and financial goals.

Education is key. Continuously learn about investing, market trends, and personal finance management. Utilize free online resources, attend webinars, or consider seeking advice from a qualified financial advisor. This will equip you with the knowledge to make informed investment decisions.

Risk tolerance is personal. While aiming for long-term growth, it’s essential to understand your comfort level with risk. Younger investors generally have a longer time horizon, allowing them to take on more risk compared to those closer to retirement. Balance risk and reward to align with your personal financial goals.

Student Loan Repayment Strategies

Managing student loan debt is a crucial aspect of financial planning for millennials. Several strategies can help streamline repayment and minimize long-term costs.

Prioritize high-interest loans: Focus on repaying loans with the highest interest rates first to reduce overall interest accrued. This approach, known as the avalanche method, can save you significant money in the long run.

Consider refinancing: Refinancing your loans could lower your monthly payments or shorten your repayment term, but carefully compare interest rates and fees before making a decision. This option is best suited for those with good credit scores.

Explore income-driven repayment plans: Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans can make payments more manageable in the short term, though you may end up paying more interest over the life of the loan.

Automate payments: Setting up automatic payments ensures you never miss a payment, avoiding late fees and potential negative impacts on your credit score. This simple step contributes significantly to responsible debt management.

Budget effectively: Creating a realistic budget that incorporates loan payments is essential. Track your spending to identify areas where you can cut back and allocate more funds toward debt repayment.

Seek professional advice: A financial advisor can offer personalized guidance based on your individual circumstances and help you develop a comprehensive repayment strategy.

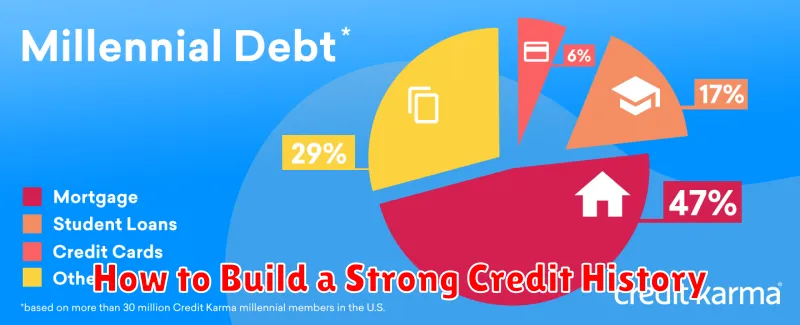

How to Build a Strong Credit History

Building a strong credit history is crucial for your financial future. It impacts your ability to secure loans, rent an apartment, and even get certain jobs. A good credit score unlocks better interest rates, saving you money in the long run.

Start by obtaining a credit card and using it responsibly. Pay your bills on time, every time. Keep your credit utilization ratio low (ideally under 30% of your total credit limit). This demonstrates responsible credit management.

Consider a secured credit card if you have difficulty qualifying for an unsecured one. These cards require a security deposit, which limits your risk and helps build your credit history. Monitor your credit report regularly for any errors or inaccuracies.

Diversify your credit by applying for different types of credit, such as a personal loan or a car loan, once you’ve established a solid credit history with your credit card. Avoid applying for multiple loans simultaneously as it may negatively impact your credit score.

Finally, be patient. Building a strong credit history takes time. Consistent responsible credit behavior will yield positive results over time. Regularly reviewing your credit report will allow you to track your progress and identify potential issues.

Side Hustles and Passive Income Streams

Millennials often face financial pressures, making diversified income streams crucial. Side hustles offer a significant opportunity to supplement primary income and build financial stability. These can range from freelancing and gig work to selling handmade goods or offering online services.

Developing passive income streams is another key strategy. These are income sources that require minimal ongoing effort once established. Examples include investing in dividend-paying stocks, creating and selling online courses, or generating income from affiliate marketing or rental properties. While requiring upfront effort, the long-term returns can be substantial.

Careful consideration of individual skills and interests is crucial when choosing a side hustle or passive income stream. Realistic assessment of time commitment and potential returns is also vital for success. Starting small and gradually scaling up allows for manageable growth and minimizes risk.

Ultimately, a combination of active side hustles providing immediate income and passive income streams generating long-term wealth provides a strong foundation for financial security and achieving long-term financial goals. This strategy allows millennials to build a robust financial future beyond their primary employment.

Retirement Planning for Millennials

Retirement may seem distant for millennials, but starting early is crucial for building a secure financial future. Time is your greatest asset, allowing for compounding returns and mitigating the impact of market fluctuations.

Begin by defining your retirement goals. Consider your desired lifestyle, estimated expenses, and the length of your retirement. This will help determine how much you need to save.

Maximize employer-sponsored retirement plans like 401(k)s or 403(b)s, especially if your employer offers matching contributions. This is essentially free money.

Explore individual retirement accounts (IRAs), such as traditional or Roth IRAs, to supplement your employer-sponsored plan. Understand the tax implications of each before deciding.

Diversify your investments across various asset classes to manage risk. Consider consulting a financial advisor for personalized guidance on asset allocation.

Regularly review and adjust your retirement plan as your life circumstances change. Life events like marriage, children, or career changes necessitate reassessment of your savings goals and investment strategy.

Start small and be consistent. Even small contributions over time can significantly impact your long-term savings. Automate your contributions to ensure regular saving.

Avoiding Common Financial Mistakes

Millennials face unique financial challenges, but avoiding common pitfalls can significantly improve their long-term financial health. One crucial step is budgeting. Creating a realistic budget helps track income and expenses, identifying areas for savings and reducing unnecessary spending.

Managing debt effectively is also vital. High-interest debt, like credit card debt, can hinder progress towards financial goals. Prioritizing debt repayment through strategies like the debt snowball or avalanche method can reduce interest payments and accelerate debt elimination.

Saving and investing are crucial for building wealth. Starting early, even with small amounts, allows for the power of compounding interest. Millennials should explore various investment options, considering their risk tolerance and long-term goals. Diversification across asset classes is important to manage risk.

Ignoring emergency funds is a common mistake. Building a 3-6 month emergency fund provides a financial safety net for unexpected expenses, preventing the need for high-interest debt in emergencies. This fund acts as a crucial buffer against unexpected life events.

Finally, lack of financial literacy can lead to poor decision-making. Continuous learning about personal finance, through books, courses, or financial advisors, empowers millennials to make informed choices and achieve their financial aspirations. Understanding investment strategies and tax implications is key to long-term success.